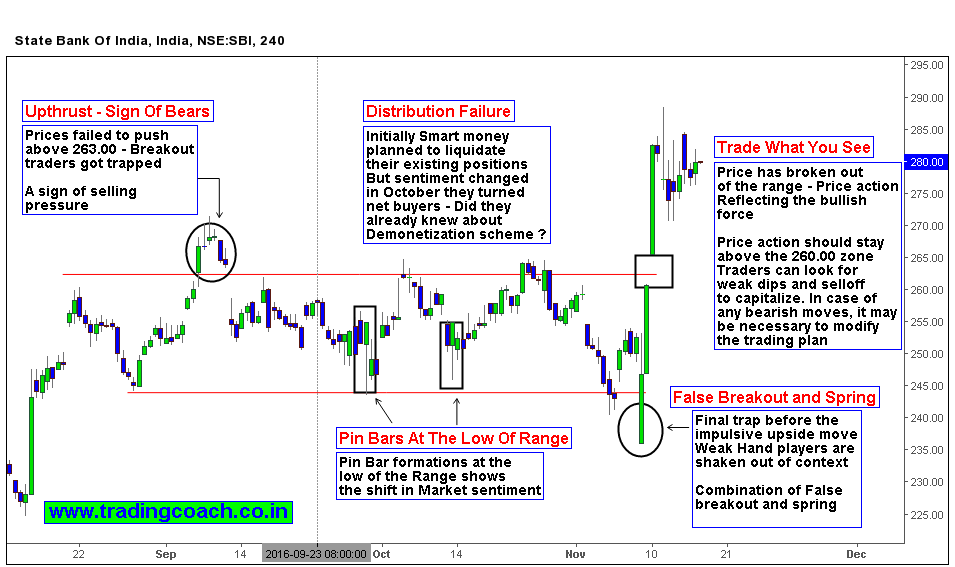

Demonetization Scheme launched by Indian government has radically altered the banking sector and perception of Investors. Stocks that once considered being risky will get a stellar boost due to upcoming changes in Balance sheet. SBI shares were trading in a volatile range between 245.00 -265.00 from last 3 months. After announcing the Demonetization of 1000’s and 500’s – Prices broke out upside from the range. Market sentiment changed altogether.

In my chart analysis (Listed above) you can view the development of Price action from the period of September 2016. (I cover about Chart analysis, Price action trading strategies and Institutional strategies in my Premium trading course) Interesting part is to notice that, without demonetization scheme the share price might be trading at lower levels. The stock price was in distribution phase from September to Mid October, after the policy move – Market sentiment shifted and Smart money changed their tactics. Eventually the Result was Distribution Failure.

Initially Smart money planned to liquidate their existing positions from September till mid October as reflected by Price action. Somehow their intentions started changing and by the end of October they were net buyers, Looks like players from Inside circles already knew about the policy moves in advance!

Traders can look to capitalize on the weakness of bears such as dips and weak corrections – Buy on the weakness at lower prices. Price action should stay above the 260.00 support zone, only then it’s a confirmation of Bullish dominance (expect some noisy fluctuations or volatile moves which might test the levels). In case of any strong bearish moves or indications, we may need to reconsider the trading plan.