Positive sentiment of stock market has taken Nifty and Sensex to new levels of 10,000 and 32,000. This is just one of the many examples of stock market adding to the wealth of investors in last few years. Outstanding performance of these mentioned stocks has fetched excellent returns for investors. Even a minor investment in these stocks before 16 years might have generated unprecedented surplus of 253% in the Portfolio. A short-term trader might have missed these passive long-term returns focusing too much on short-term speculation. So it’s always better to keep an eye on Long term picture as well.

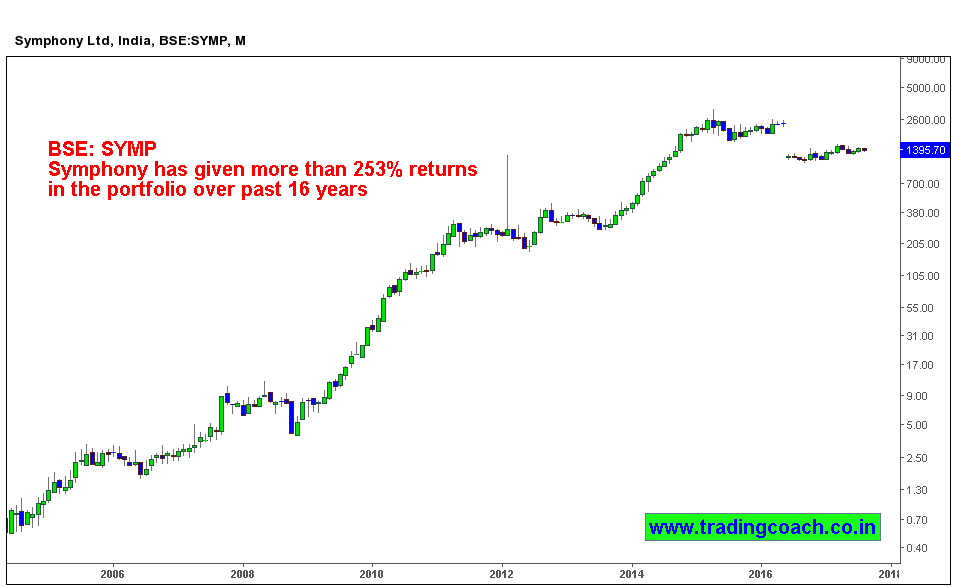

Symphony

This Company belongs to consumer goods sector, involved in manufacturing of air-cooler and related items with its registered office in Ahmedabad and its global presence across 60 countries including America, Europe, Asia and Africa. Symphony went into public on 1994 and listed on stock exchanges. In 2001, this stock was trading at Re 0.58. Currently it’s trading in the range of Rs 1,345-1,470, given over 253% returns in the portfolio!

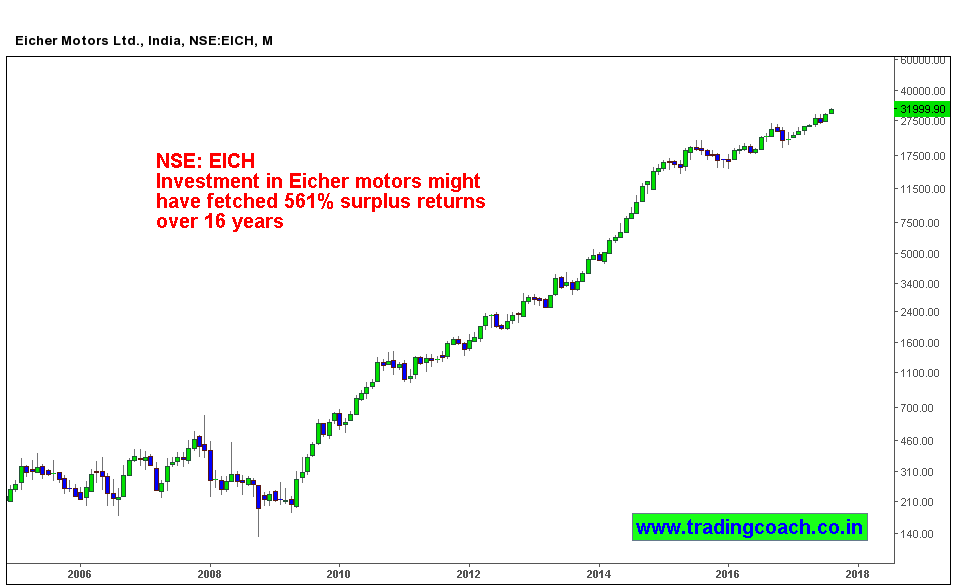

Eicher Motors

This Company belong to Auto Industry involved in manufacturing of light and heavy vehicles with its registered office in New Delhi and has its global presence across the world. In 2001, this stock was trading at Rs.19.40; currently it’s in the range of Rs 30500- 31925 giving portfolio 561% returns.

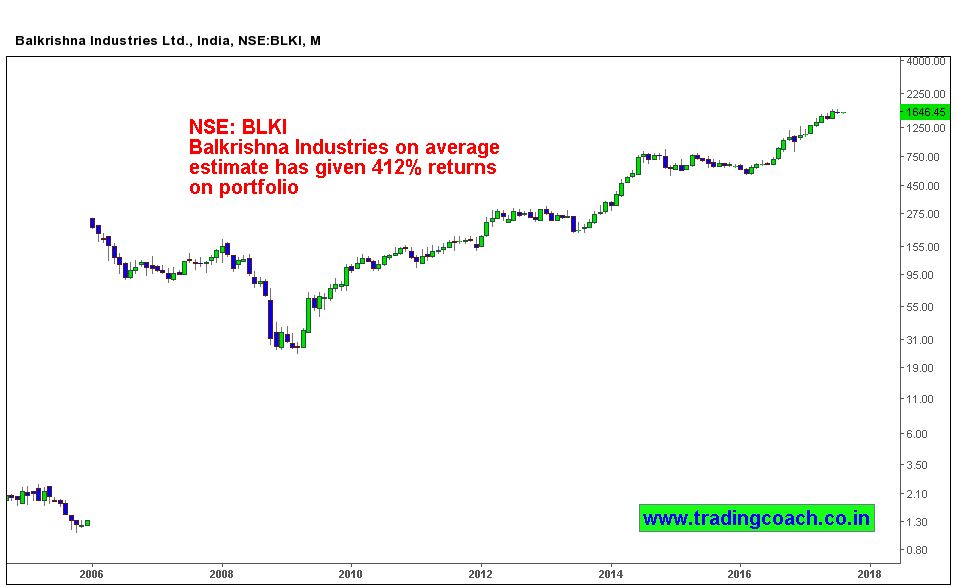

BalKrishna Industries

This Company belong to Tyres and Tubes sector involved in manufacturing of tyres with its registered office in Mumbai. In 2001, this stock was trading at Rs 1.3, now it’s in the range of 1572-1608, giving an estimated return of 412% in the portfolio.

There are many other stocks in list of BSE500 which has given smart returns during last 16 years timeframe like JSW steel (766%), Kotak Mahindra Bank (473%), Vakrangee (454%). With the above examples, if we can stay invested in the company that has growth potential, quality and sustainability then it would not be that difficult to earn smart returns over long time. There are many companies listed on stock exchange which are very strong in terms of fundamental Balance Sheet,Revenues and progressive performance. If one could find such stocks at reasonable valuation at current market scenario, they have a good chance of wealth creation over long time. I always suggest having two different portfolios – one is tactical for short-term trading using Price action, another one for long-term investment. The framework not only helps us to capture ebbs and flows of Market speculation, but also helps us to stay invested in long term potential stocks.