It all began with the MSCI Global standard Indices.

MSCI announced that it would use an adjustment factor of 0.50 to compute the weight of the merged entity of HDFC Bank and HDFC Ltd.

As a result, HDFC twins experienced a sell-off, which began early on Friday and continued throughout the weekend session.

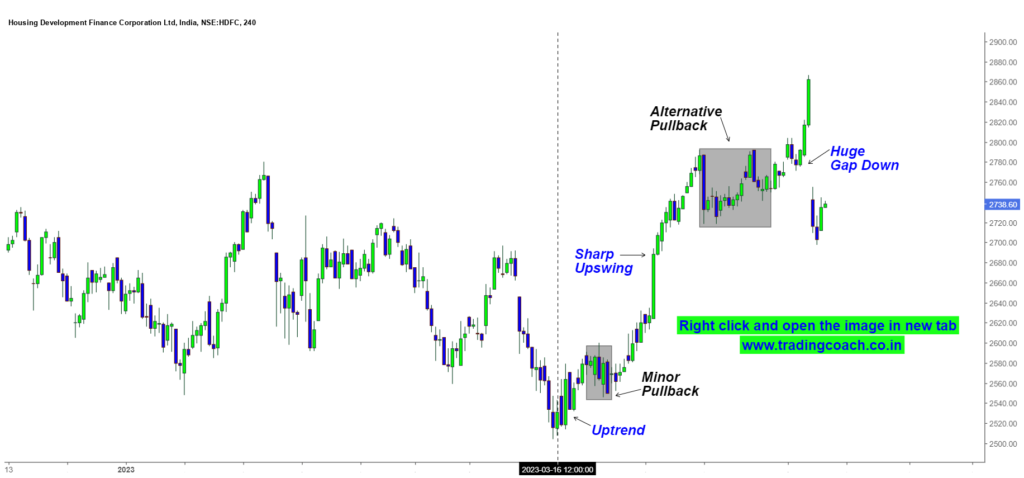

If you look at the Price Action, we could notice strong gap downs in both HDFC Bank and HDFC Ltd. These two stocks became solely responsible for the Volatile behavior in Nifty, Fin Nifty and Bank Nifty.

Take a look at the Price Action of both HDFC Bank and HDFC Ltd.

HDFC Bank – Price Action Analysis on 4h Chart.

HDFC – Price Action Analysis on 4h Chart

At the time of writing this content, HDFC Stock prices were trying to move higher and trading around 1647.00.

My thought is, prices could fill the gap, if the general market sentiment is positive and if overall market supports the price action.

To learn more about trading gap ups and gap downs, checkout the video link given below

What’s your thought and expectation of HDFC Twins? Let me know in the comments below…