Like its industry and sector based counter parts, the performance of Tata steel is largely correlated with movements of steel prices. Currently market is trading just between the notable psychological round numbers 350.00 and 400.00. As I pointed out several times in earlier articles, Round numbers contain technical imbalance of supply – demand forces unless and until tricked by algorithmic manipulation. Developing countries like India have lowest algorithmic programs, so probability of round numbers acting as support and resistance levels are quite higher. From the perspective of Price Action, Stock prices have formed three push pullback trading setups. I have written an in-depth article about the pattern in my blog.

Three Push Pullback Price Action Setup on Daily Chart

Since from the beginning of 2016, Tata steel optimally performed better on average basis. Share prices rallied from January till May where round number 350.00 acted as resistance zone and restrained further advances. The formation of three push pullback price action pattern on daily chart highlights the decreasing momentum of buyers. Fundamentally, the price action is following performance of steel and other commodities linked with infrastructure and development. Even PE, balance sheet or other fundamental factors are not good when compared with other companies. Instead Value investors and bottom pickers are loading on the stock only because of Brand value. But the strength of buyers are now challenged by three push pullback setup.

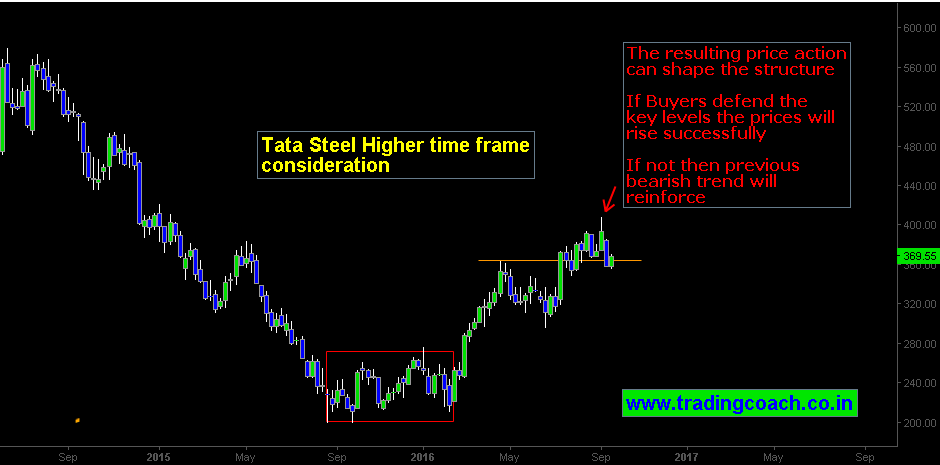

Tata Steel Share Price on Higher Time Frame for Better Perspective

By moving to the weekly chart, Structure becomes much clearer, just as usual with my analytical approach. The resulting price action for the coming days can shape the future movements of Tata steel. There is high probability that market will test the technical support zones at 350.00 and 340.00, especially to find the strength of buyers or to gauge buyer’s reaction. Reactivity of buyers will help us to comprehend the complete structure before the formation. If buyers defend key levels successfully then prices will rally, if not then earlier bearish trend will reinforce or at least uncertainty reigns in the price action.