Supply and demand, when sellers and buyers agree on a trade, determines asset prices. Market Psychology has tremendous impact on asset prices. Presumably, if a substantial number of transactions occur at one price, the price is telling us that supply and demand are in a temporary equilibrium (Range bound) and that both buying and selling pressure are satisfied. Practically, in the financial markets, long-term equilibrium is rarely reached. Prices constantly change, if only by small amounts, as they move towards equilibrium. They can oscillate in small increments or large; they can go up and/or down; or they can do both.

Read about Supply and Demand here

PRICE MOVES BECAUSE OF BUYERS, SELLERS AND MARKET PSYCHOLOGY

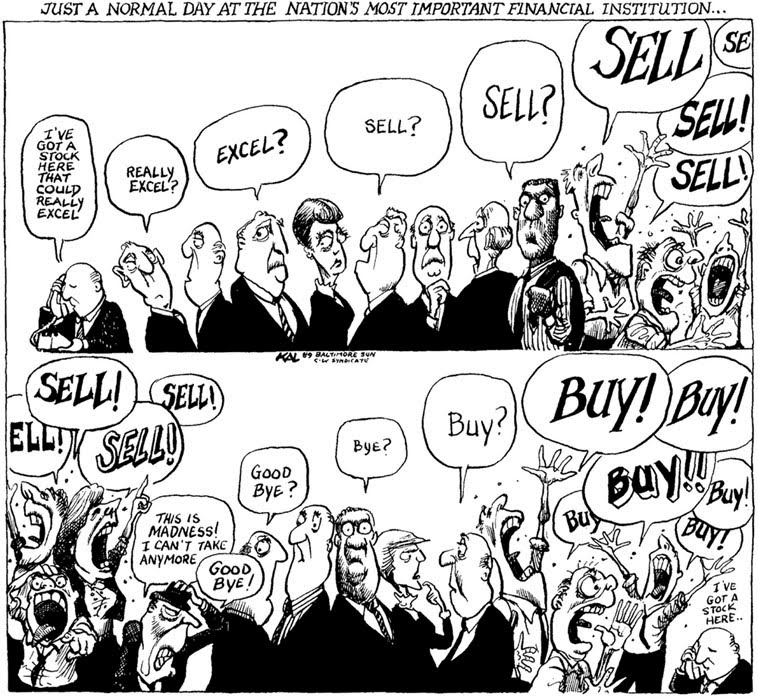

Whatever the price movement, it is ultimately determined by the expectations and power of the buyers and sellers. If broad expectations are for a higher price in the future but with little or no capital to act, prices will remain as they are or even decline. Of course, expectations change, as does the power to act. Nothing is perfectly stable or constant in the markets. Market psychology is constantly in a state of flux. In every transaction, there are an equal number of shares transacted, and, thus, there is always temporary equilibrium between buyers and sellers at that instant in time. An Intelligent Price action trader anticipates and rides the trend, as long as it continues. Nonetheless, his sole focus is on Market Psychology and its dynamics.

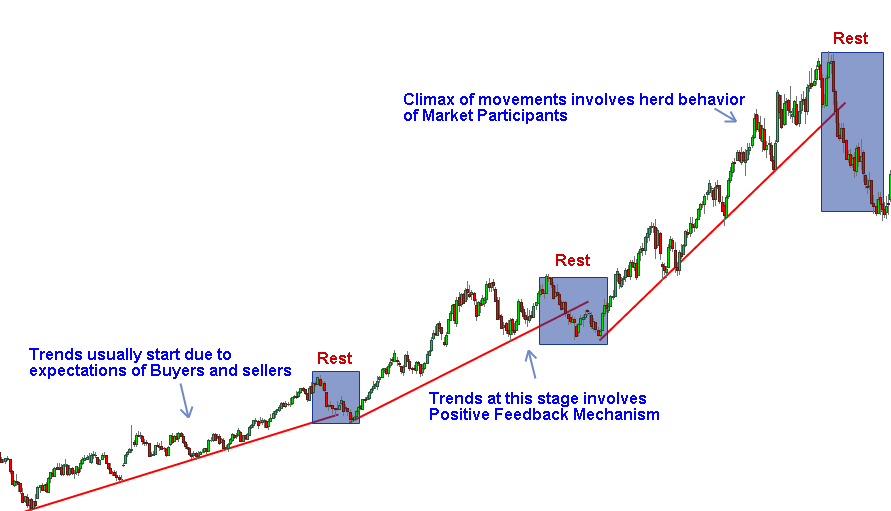

When prices travel in a trend, called trending, they remain headed in one direction, and they tell us that there is an imbalance of demand and supply. Trends are fractal, in that their behavior is the same regardless of the period. Minute-to minute trends behave exactly like day-to-day trends with only minor differences because of the understandable variation in liquidity over the shorter periods. Dow suggested there were three principal time horizons—the primary, the intermediate, and the minor. What makes a trend is the power of the buyers or seller and the aggressiveness or anxiousness of buyers and sellers—they have specific information or deductions, rational or irrational, or are emotions of fear or greed propelling their actions. This is what we refer as Market psychology.

MARKET PSYCHOLOGY IN TRENDING PRICE MOVEMENTS

We know from behavioral studies that, Market psychology, a positive feedback mechanism in market participant minds tends collectively to support that trend. In an uptrend, for example, buyers who have profited tend to continue being buyers, and new buyers, seeing what they have missed, also buy. The price trend continues upward. Eventually, over a longer period, prices revert to a mean or value, but meanwhile, they trend, up, down, or sideways. If, for example, prices are gradually rising, then buyers must have stronger positive expectations and be willing and able to place more money in the security. Contrarily, if prices are declining, sellers must have stronger negative expectations and larger positions to sell. The price trend, thus, tells us the amount of power, aggressiveness, and anxiousness in the marketplace to buy or sell each security. Market Psychology plays an extraordinary role in trending period. Through Price action, we can visualize the structure.

New to Price action? Read about Price action and Market structure…

The trend is never a straight line. Then it would be too easy to tell that it had reversed. Instead, the trend is a direction and not a line. Many doubting participants often go with this direction. Sometimes, it can be arbitrageurs, who bet against the trend or who are merely trading the spread. More likely, it is investors or traders running out of money or stock or just holding back for a little while, hoping that the price will retrace back toward their orders. In other words, the security price oscillates in smaller trends along its travel in the larger trend. This makes determining when that larger trend is reversing a difficult decision because any signs of reversal may only be for smaller trends within the larger trend. Additionally, securities occasionally “rest” during a trend and move sideways as the earlier rise or fall is “digested” by all the different players. The Market psychology of what causes these spurts, stops, and retracements is an interesting study.