In Q3, both foreign as well as domestic institutional investors increased their holdings on some blue chip stocks from NSE Nifty 50 Index, such as Hindalco Industries, Ultratech Cement, Tata Steel and Kotak Mahindra Bank. Keep an eye on these Stocks in nearest future.

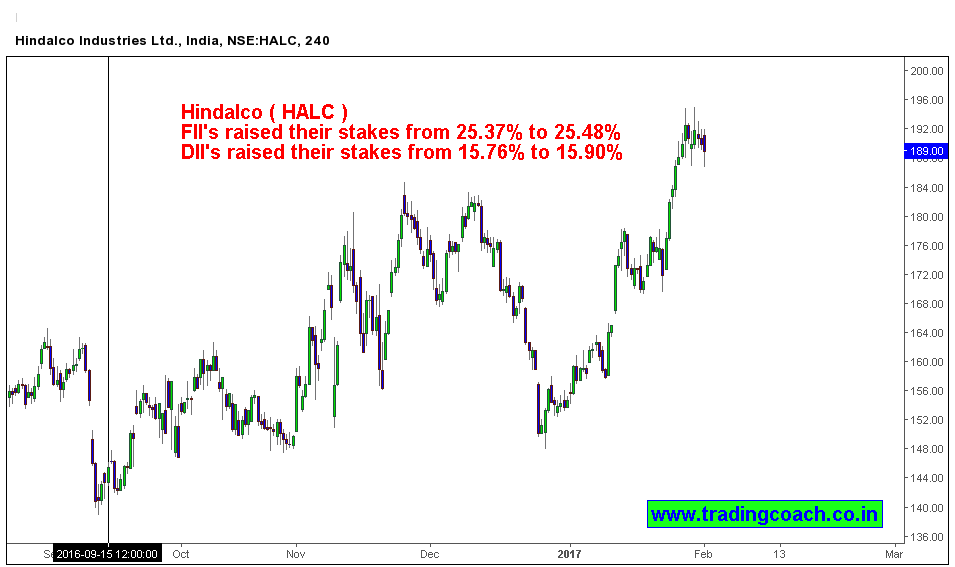

Hindalco (HALC)

According to data provided by corporate database Capitaline, the investment in Hindalco rose by 0.11% that is from 25.37% to 25.48% in Q3 by FIIs. DIIs also raised their investment in this company by 0.14% that is from 15.76% to 15.90%.

From October 2016 till January 2017, Hindalco share price has risen by 24% and it is trading at INR 190.15, presently. The Q3 earnings will be announced by this company on 13th February 2017.

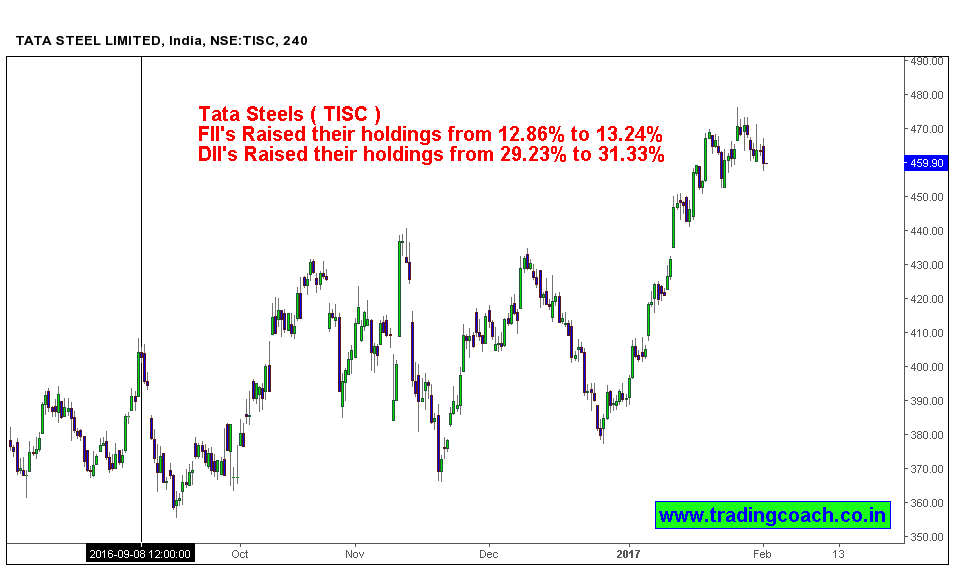

Tata Steel (TISC)

FIIs raised their holdings by 0.38% that is from 12.86% to 13.24% in Tata Steel. On the other hand, DIIs increased the investment by 2.10% that is from 29.23% to 31.33%. Tata Steel share price rallied almost 25% from October 2016 till January and it is currently trading around INR 468.95.

Tata Steel announced on January 25, 2017, an agreement with Creative Port Development Private Limited (CPDPL) collaborating for the development of the Subarnarekha Port which is in Balasore district of Odisha.

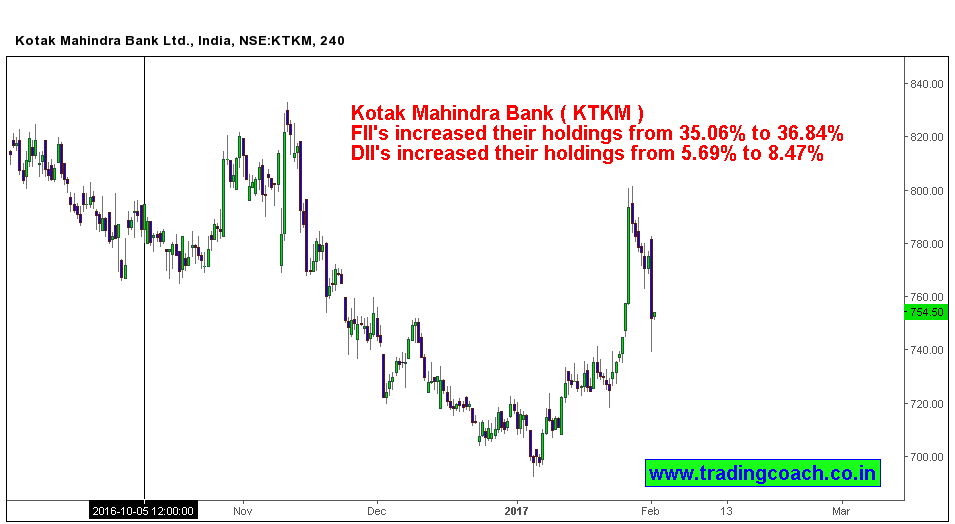

Kotak Mahindra Bank (KTKM)

The favorite stock from banking sector for FIIs seems to be Kotak Mahindra Bank. FIIs increased their holdings from 35.06% to 36.84% within the end of September and December 2016.

DIIs also increased their holdings from 5.69% to 8.47%. The profit of the bank increased from 634.72 crores in last year’s Q3 to 879.76 crores in this financial year’s 3rd quarter, while the income increased from 4,843.86 crores to 5,377.83 crores.

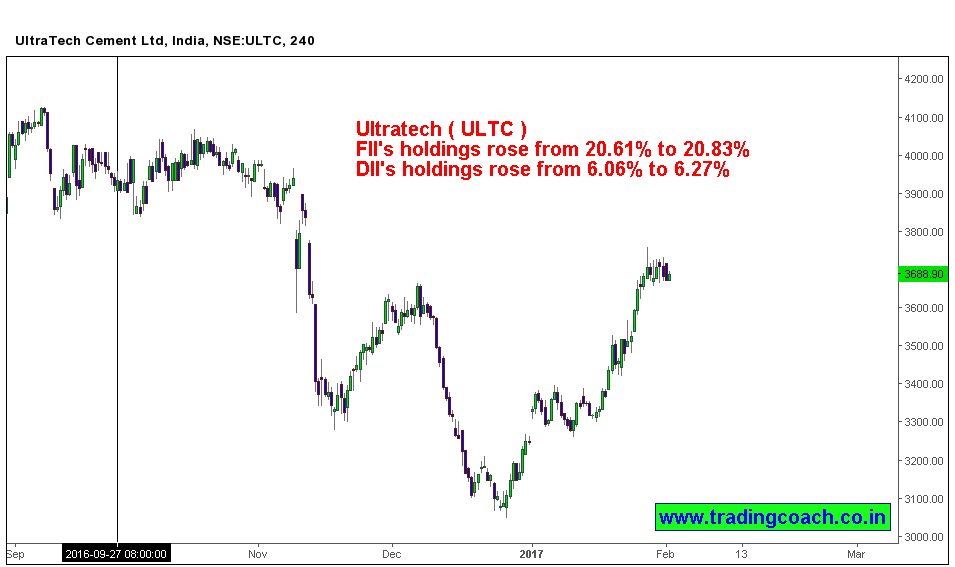

Utratech (ULTC)

Ultratech emerged as their favorite in the cement sector. The holdings by FIIs rose from 20.61% to 20.83% through Q2 and Q3. DIIs raised their stakes from 6.06% to 6.27%. But share prices fell from 3,857.90 to 3,681.50.

The domestic equity market was highly volatile during the 3rd quarter because of demonetization and unexpected victory of Donald Trump as US president. Beside these two reasons, FIIs withdrew their money from emerging markets because of increase in US interest rates and dollar value.

From October 2016 till January 25th, 2017, FIIs withdrew 34,000 crores from Indian Market while DIIs invested 39,300 crores.