Famous Trader George Soros once quoted,“Money is made by betting on the unexpected and discounting the obvious”. It applies very well in the present situation, as most of the traders are hell-bent on Bottom picking the Stocks, the Commodity segment is giving far better opportunities and trades, is completely ignored.

Even Big players such as Hedge funds, Quantitative firms and Algorithmic Institutions have shifted their focus to Commodities, after Covid – 19. As an evidence of their activity, assets like Gold, Silver and Natural gas are witnessing high Volume and sharp price movements. Liquidity has improved a lot and Volatility has significantly balanced out in the Commodity market, making it possible to find highly successful trades.

Here are some of the Excellent Price Action Trading setups, occurred in certain commodities. Take a look at these; you’ll understand what I am talking about.

Gold

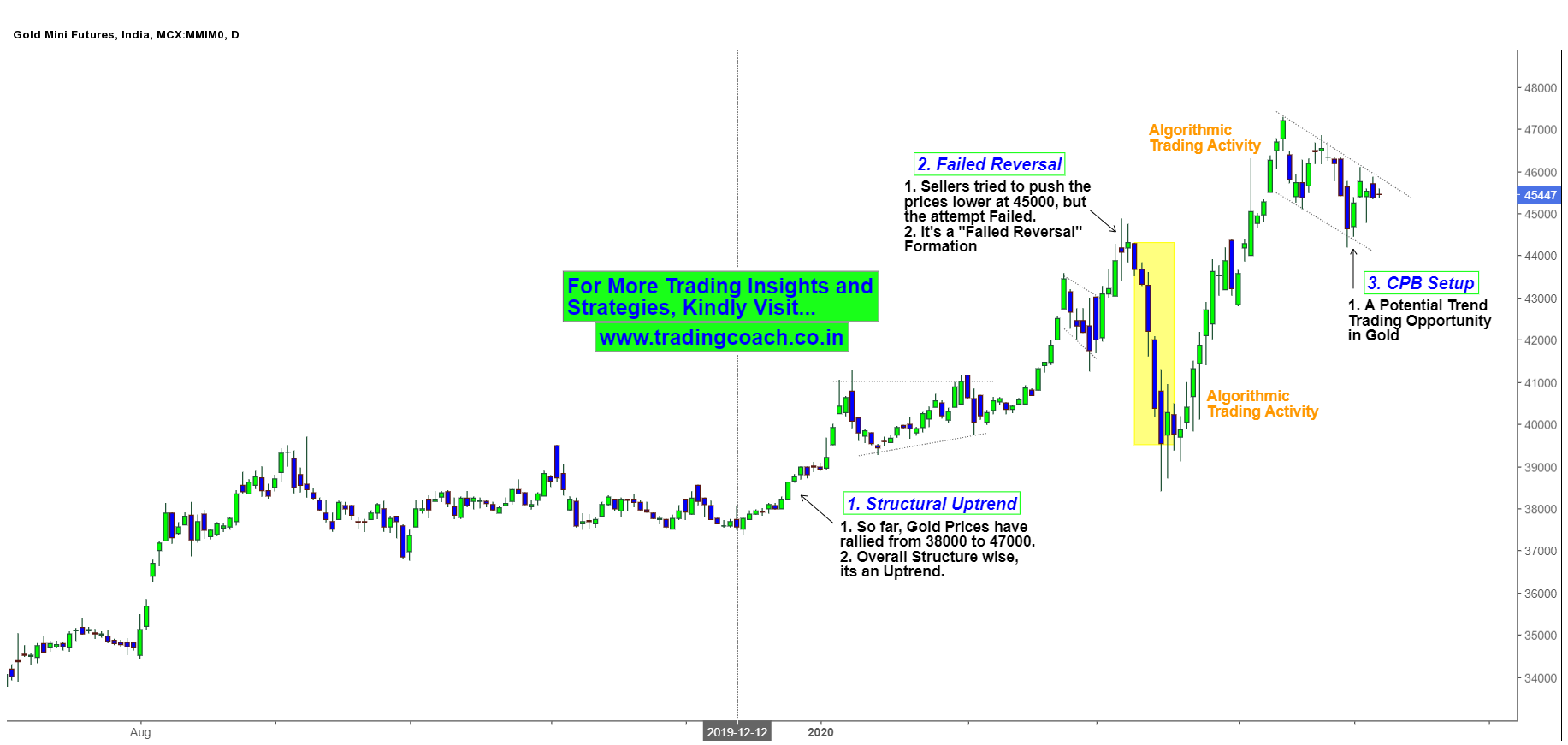

Gold Prices are in Structural Uptrend, so far has rallied from 38000 to 47000 which is almost a 30% increase in price value. Gold is a Metal of Fear; it’s completely driven by the Market Sentiment and has a tendency to outperform during bad times.

When you observe the recent Price action in depth, you can spot multiple Algorithmic trading activity taking place in Gold. Setup wise, we have a CPB Pattern which gives a potential trend trading opportunity.

Copper

Copper prices have fallen drastically from 450 to 350 and structure wise it’s a Downtrend. We can see activity of Big Players taking place in the Metal at important turning points. Copper is an Economic Metal because of its widespread application in sectors such as Housing, Manufacturing, Construction and Electrical etc.

Taking a trade in Copper is equal to trading the global economy. And due to that, we can see a Retracement Setup taking place in it.

Natural Gas

Natural Gas underwent a major Structural reversal and it’s currently trading in a Range bound market. Respectively, the Support zone is at 120 and Resistance zone is at 150. Even though it’s highly correlated with Crude Oil the fundamental variables influencing the price movement is completely different, namely – Consumption.

From the last couple of weeks, some major Oil dealers are diversifying their investments into Natural Gas to protect their business concerns. Because of the increased demand from Oil dealers, we can see a Range breakout Trading Setup formed in Natural Gas.

Like these there are multiple trading setups taking place in different commodities, on different time frames. Given these outstanding opportunities, it’s a wise decision to focus on Commodities like what most of the big players are doing. Not only that, commodities often form strong price trends during the period of crises and turmoil. Because of that one can find excellent setups with advantageous risk – reward in the Segment.

Hence active traders who mostly involve in futures and options should try to add commodity in their portfolios on upcoming days. Not only will it help to capture high probability opportunities but also provides some added diversification to your trading performance.