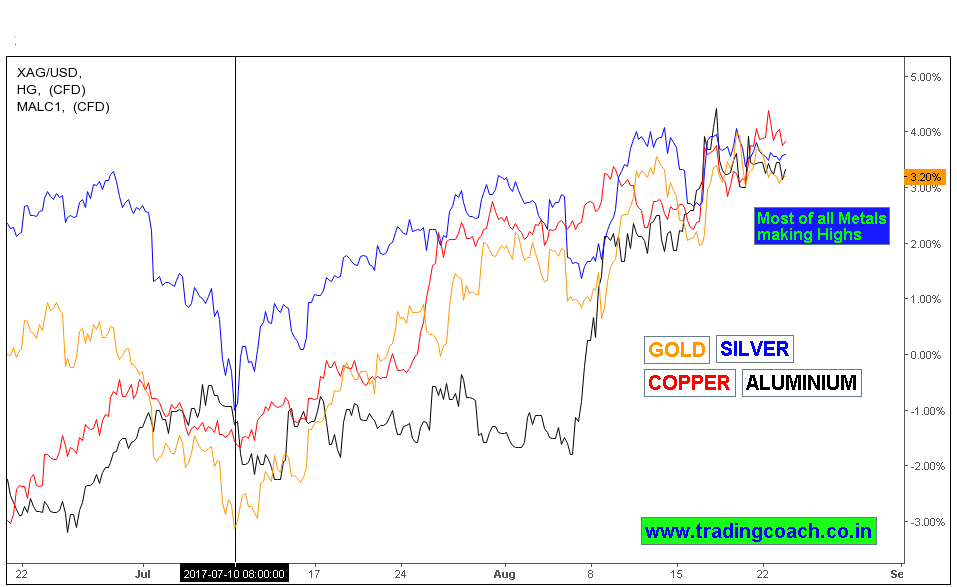

Being a Trader also means being apathetic to market tantrums and fluctuations. Our emotional discipline must be strong enough to overcome the cognitive biases of greed and fear. The Recent price action of metals is a great test on trader’s patience and mindset. As global metals are reaching its highs, Participants are turning spectacularly bullish and Market sentiment is nearing its extreme.

I spoke with some MCX traders in past few days; most of them have shown a sense of worry on missing out the Trend. In other words, they’re distracted for unable to capture the bullish trend in Aluminum, Copper, Gold, Silver and zinc

What’s worse is that, some are forcing their trades even when they knew there are no proper setups or Risk – reward! This is what we mean by over trading!! It’s getting tempted by Market fluctuations or Profit expectations. These types of mistakes are not just made by Novice traders, even professionals fall prey to it.

Remember, Metals are trading near potential resistance zones. The rally is caused by Investment funds seeking safe heaven in the landscape of geopolitical risks. Falling dollar value, Diplomatic crises with North Korea, Volatile stock markets are reason for Big money Investors running into Base metals and precious metals.

Metals are In Overbought territory and Liquidity is drying up. I would be cautious in taking long trades as risk – reward is completely skewed. It’s better to pick them after a decent correction or bet on temporary downside (if we see a good selling pressure based Price action setup). Don’t get tempted by Price fluctuations instead focus on capturing Good trades.