Gold Prices have rallied consistently from last 2 years. Given the Covid situation, turmoil and Volatility, Institutional Investors seeking safe heaven investments poured their money into Gold and Gold ETF’s. But as the Global Markets are rapidly increasing in value, bets are unwinding in Gold. As a result, Gold prices have declined from last few weeks. So far, prices have depreciated around -12%.

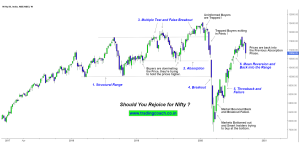

As per my thoughts, this could be a starting point of an Intermediate correction in Gold Prices. To understand what I am saying, take a look at the Price Action Analysis on the Weekly chart of Gold, Given above.

The Uptrend we are witnessing now in Gold Prices, started way back around August 2018. Prices have rallied all the way from 30000 to 56000, then from last few weeks prices corrected and declined up to 50000.

Even though it’s a major fall on lower time frames, the correction looked like another retest on Weekly Chart. The present trend is a good example of overbought market behavior. Hence my expectation is that, the third retest could turn out be a failure (Take a look at the Chart) and prices might unfold into a Range or goes into an extended intermediate correction.

Traders should keep an eye on the Price Action of Gold on Weekly chart, as interesting opportunities might present themselves in coming days.