The recent increase in gold prices is primarily due to global factors such as the fears around the global banking crisis and a stronger dollar, which has driven up the demand for safe-haven assets like gold. The recent increase in US interest rates by the Federal Reserve can also impacted the price of gold in the international market.

Gold tends to perform well during times of credit stress and contagion risk. However, the recent actions taken by central banks and governments to contain these risks may ease concerns about the global banking system and reduce the demand for safe-haven assets like gold in the short term.

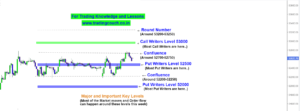

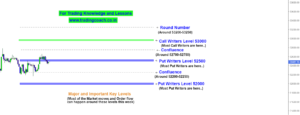

Gold – Price Action Analysis on 5H Chart

In the short term, the price of gold is likely to remain volatile and range, could be influenced by a variety of global and domestic factors. However, over the long term, the demand for gold is likely to remain strong due to its role as a store of value and a hedge against inflation.

Traders and investors should monitor the price action of gold and make decisions based on the prevailing global market sentiment. Important resistance zone is around 59700 and support zone is around 58400.

These areas can change over time as market sentiment and the supply and demand dynamics of the market shift. Therefore, traders and investors need to constantly monitor the price action (To learn more about Price Action strategies checkout the video given below) to adjust their trading strategies accordingly.