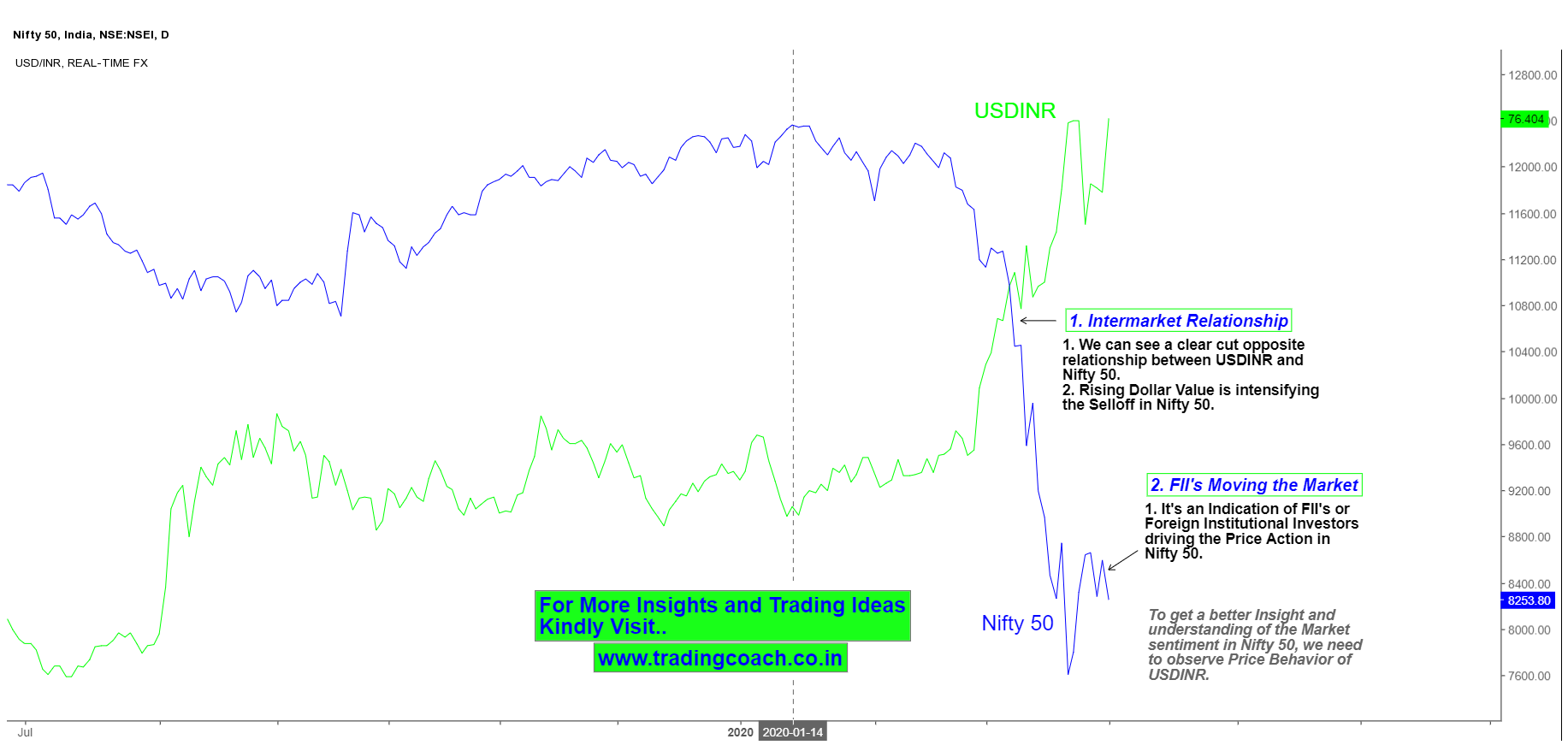

Take a look at the Interesting Chart above. It pinpoints the Intermarket relationship between USDINR and Nifty 50. Incase if you’re wondering “what is Intermarket Relationship?” go through one my earlier contents on Intermarket Analysis. In a nutshell, Intermarket relationship studies the relationship between two different assets or Instruments. In this case we are considering the relationship between USDINR and Nifty 50.

If you notice the direction of USDINR and Nifty 50 in the given chart, you can spot an opposite relationship between both the assets. Rising USDINR is intensifying the selloff in Nifty 50. In a simple sense, rising dollar value against Indian rupee is leading to further decline in Nifty 50 Index.

If you think deeply about this, you can see it’s an Indication of FII’s or Foreign Institutional Investors squaring off or liquidating their holdings from Indian markets.

When FII’s want to invest in Indian markets; they’ve to convert USD to INR, which would cause the Dollar value to decline against Indian rupee. Vice versa, when they want to liquidate their investments; they’ve to convert INR back to USD, which would cause the Dollar value to shoot up. In the present situation, we are witnessing a similar scenario.

It’s very wise to conclude that FII’s are driving the Price Action in Nifty 50 or at least majority of the sharp market moves we have seen so far, happened because of that.

So in coming days, to get a better insight of Market sentiment in Nifty 50, Traders should keep an eye on the Price Behaviour of USDINR. Doing so will give an informed perspective to trade the markets.