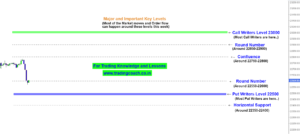

INDEX: BANKNIFTY is now trading at 32783.70 in a Structural range. After banking stocks surged in the middle of Feb 2021, the Bank nifty Index made an all-time high and then quickly moved into a Range.

Bank Nifty Price Action Analysis on 1D Chart.

Late Buyers, who took positions at top, at all-time highs, got Trapped in the market when prices unexpectedly changed the direction. Most of them are likely to uninformed retailers who joined the rally at a later stage. Right now, we can notice that Prices are holding at the Support level around 30500. Also we can see a parallel resistance, acting as a strong selling point.

Despite multiple attempts to break the level, Prices couldn’t move beyond the narrower lines of support and resistance. The sudden increase in the volume – aka Volume Spike, tells us about the large number of participants liquidating their positions.

As Bank Nifty is trading in a Structural range and narrowly holding at the Support and Resistance, it has to Breakout on the either side for more clarity. Expect the Market Sentiment to stay uncertain, until the prices breakout.

Going long or short is not a good idea unless and until we see a Good Breakout in either direction. Till then, prices might continue to range within those narrow lines of support and resistance. Traders should keep an eye on the Price action and take trades only when momentum the picks up.