Bank Nifty was rallying strongly until last week. Prices went up from 32500 all the way to 39500.

But after testing the levels of 39500, Prices couldn’t push any higher and as of now, at the time of writing this content, Bank Nifty Index prices are trading around 38500.

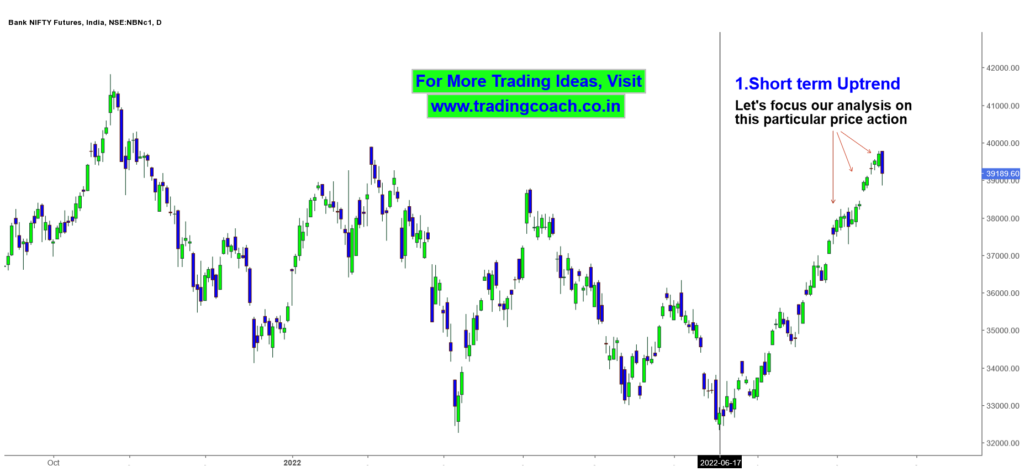

Right now, Price Action shows several signs of Trend Reversal. If the Selling pressure persists in Bank Nifty, prices are likely to drop further. Let’s focus our analysis on the short-term Uptrend that we see in Bank Nifty.

Bank Nifty Index Prices – Short Term Uptrend on Daily Timeframe

For clear cut analysis and to understand what’s happening behind the scenes, take a look at Bank Nifty 2h Chart.

Bank Nifty – Price Action Analysis on 2h Timeframe

After testing the levels around 39500 – 40000, selling pressure is increasing in the Bank Nifty Index.

As an Indication of Selling pressure, we can also see a strong volume spike in the recent Bearish candles.

Traders and Investors who have taken long positions at peak levels are likely to be trapped in the market.

If the present circumstances continue further, the short-term Uptrend in Bank Nifty could reverse into a Sideways Range or Downtrend.

Major Support is at 38000 and Resistance is around 40000. Keep an eye on the Price action and trade accordingly.

To know more about Price Action Analysis and how I analyzed the Bank Nifty Behavior, take a look at the Video given below, it may help you to get more insights.