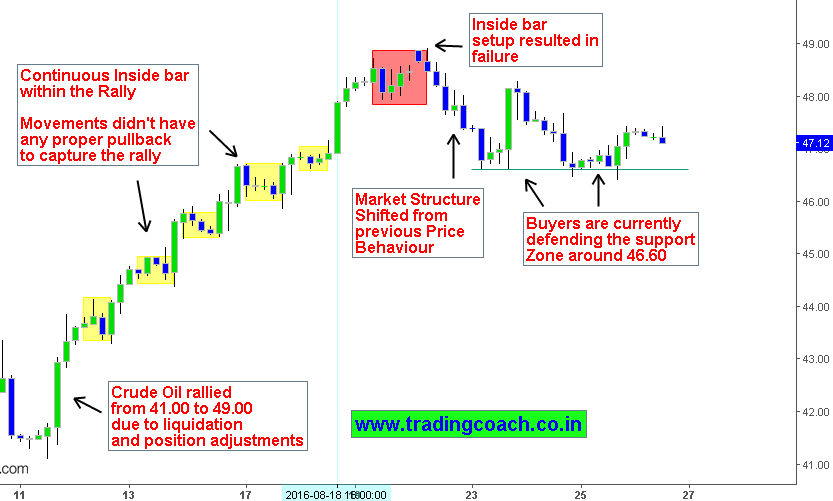

Crude Oil trading near $47 per barrel as rumors about output freeze takes toll once again. Prices bounced after state news reported that Iran oil Minister would attend the informal meeting on Algiers next month. Hopes for supply side accord is pushing oil prices higher from last couple of days. As I mentioned on earlier articles, OPEC and events related to the organization is driving the market sentiment and Price action. On 4h chart, Crude oil Market structure has shifted. Buyers are defending the support zone $46.60.

Price Action Trading at Support Zone

The Likelihood of upcoming OPEC meeting ending up with positive outcomes seem far from normal. From the point of Geopolitics three principal parties Russia, Iran and Saudi Arabia are currently at odds on at least two different military conflicts. Oil Market entered in Bullish phase around August 12, Market rallied from $41.00 to $49.00 per barrel due to speculation about OPEC taking action to stabilize market prices. Price Action is simply moved by liquidation and positions adjustments by smart money players ahead of coming uncertainty. The recent rally didn’t have any structural pullbacks and consisted of inside bars, capturing such type of moves is a daunting task. The perspective becomes clear once we highlight the Market structure.

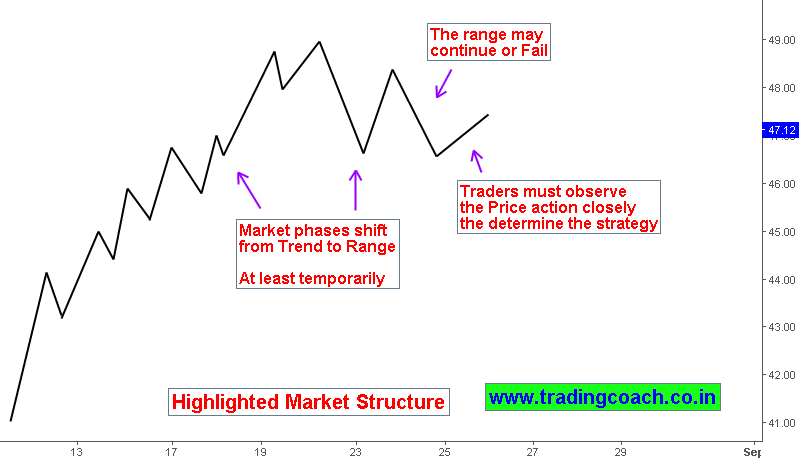

Technical Analysis – Market Structure Shifted From Trend to Range

An agreement to limit the production levels at current situation might not stabilize the market prices as expectations of OPEC members. Overhanging crude oil inventories and US shale oil producers might obscure the process of market achieving equilibrium. Around 22 August, Market structure shifted from previous price behavior as price action failed to make further highs. Buyers are currently defending the support zone at $46.50 -$46.60. Recent price range might continue for upcoming days or fails to sustain if any important announcements come out. Traders should observe the Price action closely to decide the trading strategy.