2015 Trading year started with a bang as I warned in my one of my article that investors should brace for volatility.The best way one could’ve approached this year as a contrarian Investor. I hope this article will shed some light into most important and less known methodology

Guts of a Contrarian Investor

Baron Rothschild, 18th century British nobleman and banker once said “Buy when there is blood in the streets, Sell when everyone is rich “. This quote gives an uncanny insight into the tactics of a contrarian investor, being a contrarian investor is not so easy, but the profits that come after this method will be overwhelming. A contrarian investor goes opposite of the crowd at the right time and makes a killing in the market! .For example if Everyone is bullish on the market, fully invested without further purchasing power ,market will reverse and turn into a bloodbath which distorts the real value of a stock, Creates an opportunity for a value investor.

Going against the Crowd

Contrarian as the name indicates, trying to do the opposite of the crowd. They search opportunity in distressed selling and euphoric buying. They assume that markets are usually wrong in their extreme highs and lows, more the price extremes, more confused the market and opportunity for contrarian

Bad times give best plays

Philosophy of contrarian, always look for bad times and price extremes without any sufficient reasons. Especially after a short-term panic or secular market crashes, majority of the stock values distorted without any fundamental background vice versa for bears-after an extended up move or euphoric condition stocks will be overvalued. So in contrarian’s terminology “Bad times are the best times,Good times are the bad times”.when everyone runs, it’s better to walk!

Simple Practical application of contrarian ship:

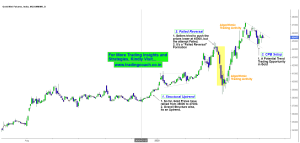

1.Search for most extreme sell off or buy off recently

2.Look for price extremes

3.Analyze the reason behind the movement

4.Use commonsense to understand whether the movement is valid or hoax

Conclusion

There are risks to contrarian investing-Investors must make sure the market is indeed wrong, To play against the current opinion, some of the famous contrarian investors didn’t chased the market rather let the opportunities come to them .If applied with proper research or valid method, Contrarian investing gives best profit!!