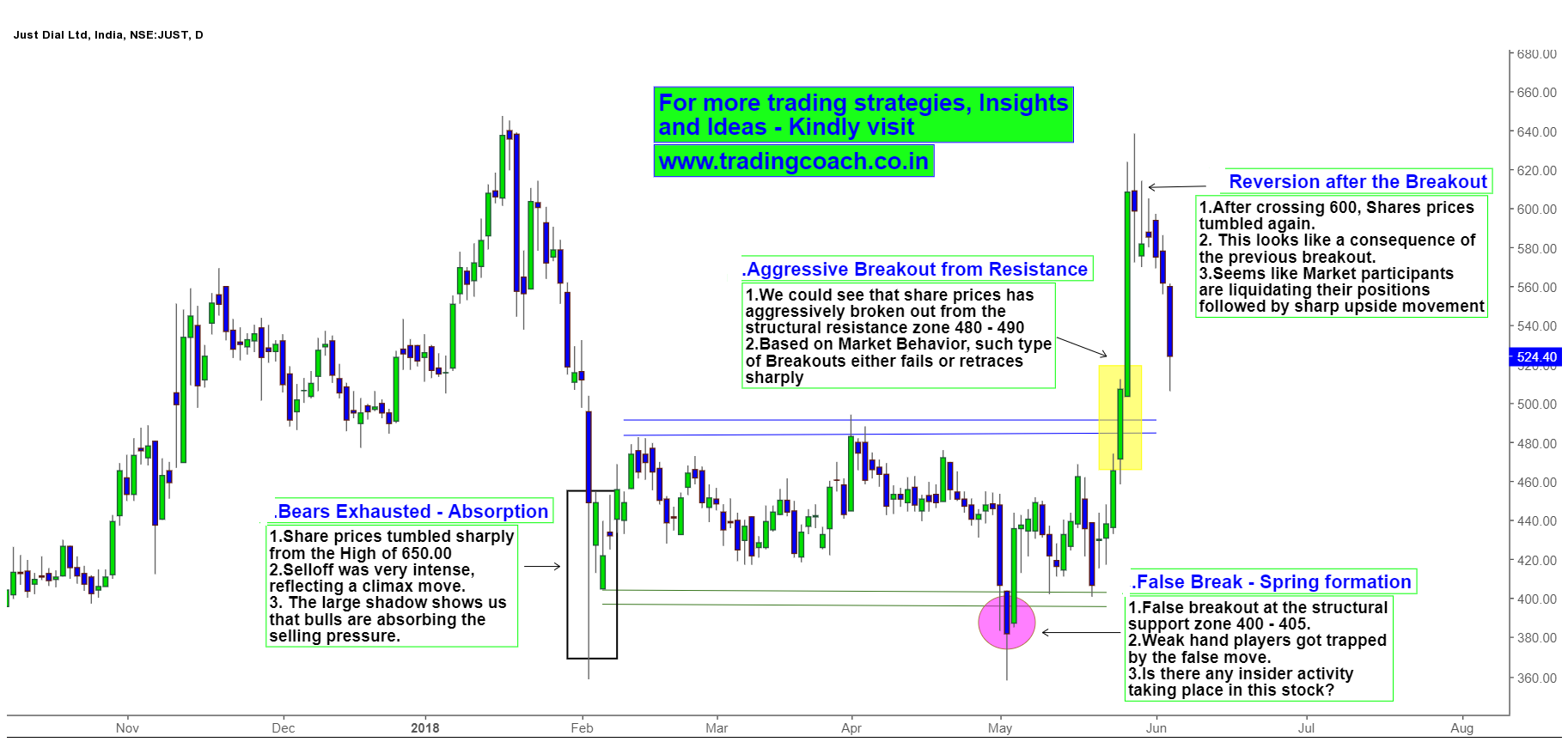

Just dial is one of the Midcap stocks in which price action is very volatile and random. Most of the time just dial share prices are driven by fundamental event and general market conditions. But in few occasions, Market sentiment takes the driver seat. Right now, that’s the case. After the firm reported growth in net profit in the end of May, Share prices sky rocketed from 460 – 600 in less than two weeks. But from the beginning of June, Sentiment has completely changed. In last couple of days, share prices fell from the previous high of 600 and now trading close to 530. The classical Breakout and Mean Reversion structure.

Just dial Price action Analysis on Daily chart

Just dial Share prices was struck in the range from Feb till last week of May, that’s almost 5 months. Price action formed Structural support zone at 400 – 405 and resistance zone at 480 – 490, based on the range. In the beginning of May, prices tried to break the support zone but eventually turned into false breakout formation. Weak hand traders got trapped by the false move and forced to liquidate their positions. This is also similar to a classical spring formation; hence we can suspect insider activity in the stock.

Then at the end of May, Just dial announced growth in net profit and other key business statistics. Right after the announcement, share prices aggressively broke out from the structure resistance zone. The strong rally that preceded the breakout almost resembled climax pattern. But after crossing 600, selling pressure came into dominance.

Based on what we see now, Share prices are retracing after the breakout. Market participants and some smart players are liquidating their earlier positions. We may get some potential swing and positional trading opportunities in coming days, Hence keep it on your watch list.