Volatility and uncertainty is all over the markets. It’s a better idea to glance at the major falls that took place in some notable financial shares using Price action. It could help us to navigate the present uncertainty in the markets, especially with financial sector stocks.

The turmoil in financial sector companies like NBFC, Housing Finance and Public sector banks impacted the share prices and Investor sentiment. Improper management of financial sector is the main reason to blame. But also macro factors like weak rupee, rising crude oil prices and higher interest rates, all had their fair part on the brewing liquidity crises. In my earlier price action analysis on Bank Nifty, I already pointed out the overbought conditions. Looks like Investors and Market participants have finally realized about it.

Even though everyone is paying attention now, some of these stocks were in downtrend even from the beginning of this year. The quote of one of the notable trader Tudor Jones “Price moves first, Fundamentals comes next” has proved itself again.

Price action of some prominent financial sector stocks

Dewan Housing Finance – Price Action Analysis on Daily Chart

Dewan housing Finance Corporation is a deposit taking housing finance company. Share prices lost nearly 30% due to fears of Liquidity crises within the firm, which still continues to haunt the Market sentiment. Some Big players and Market participants got panicked after internal issues came to media spotlight, as a result stock prices tumbled from 675 to 300, just in less than 2 weeks. Unless and until there is some clarity of Fundamentals, it’s better to stay away from this stock.

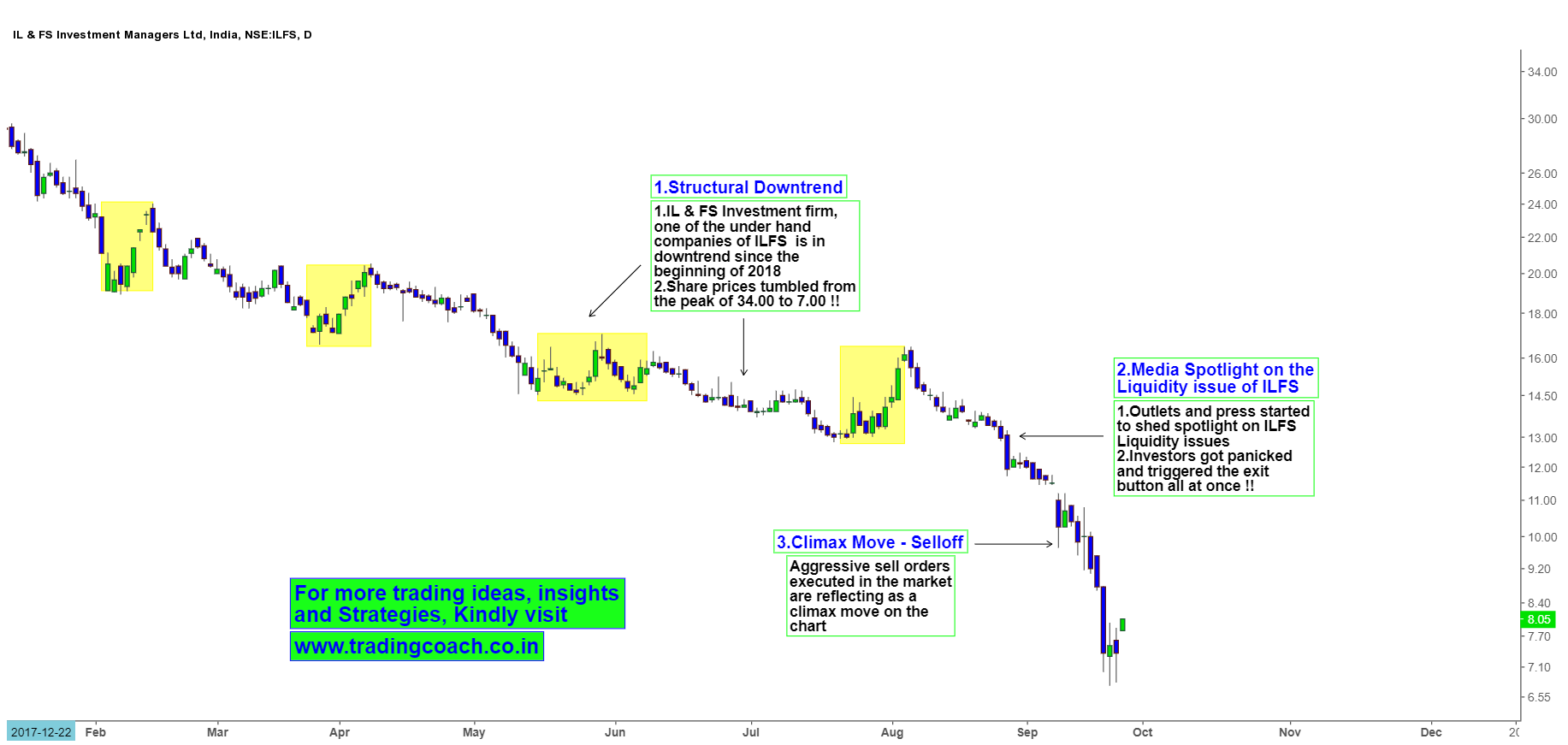

IL & FS Investment Managers – Price Action Analysis on Daily Chart

IL & FS Investment Managers limited, a subsidiary firm of IL & FS – one of the leading infrastructure development and finance company in India. The firm first shocked the markets and investors, when it postponed a $350 million bond issuance in March. Company faced a strong issue in meeting its short-term cash flow needs as the revenue from its assets are skewed towards the longer term. The price action on Daily chart reveals that the stock prices are in Downtrend since from the beginning of 2018, Shares fell from peak value of 34.00 and trading around 7.00 per share!! Probably it’s better not to touch it, till Market Sentiment changes.

Yes Bank – Price Action Analysis on Weekly Chart

One of well-known Private sector bank in the country, Stock prices almost 30% in response to management issues about CEO Rana Kapoor’s Extension. Uncertainty over the Bank’s Future caused panic among Investors and Market participants. As a result, share prices tumbled from 380 to 240 in a couple of weeks. We can see a sharp selloff in the weekly chart of Yes Bank. Market sentiment has completed changed in the long-term structure. Though the firm is facing management issues in the short-term, the fundamentals are inherently good which makes it a better long-term bet.

Traders should be careful and must take trades with proper calculation and risk management. Market conditions, especially financial sector stocks are pretty volatile and uncertain, hence it makes sense to be patient and wait till the right opportunity presents itself. Keep an eye on the Market sentiment and developing Price action, trade accordingly. Incase if you find yourself making impulsive trading decisions then remember the quote of legendary Trader Jesse Livermore “They say there are two sides to everything. But there is only one side to the stock market; and it is not the bull side or the bear side, but the right side”. Best wishes