So far it’s a rough week for Traders; Markets are driven by the jitters of News events and Year end Volatility.

Talking about Nifty 50, the Index is experiencing a Structural Selloff; we can clearly see it on the Chart. In one of my previous video, I have already warned about the Selling Pressure mounting up in the Index Prices.

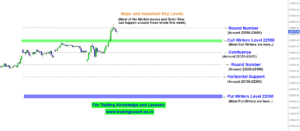

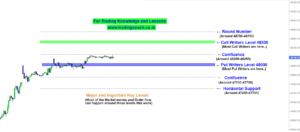

Take a Look at Price Action Analysis on 5h Chart

Nifty 50 Price Action Analysis

Markets are likely to continue the Bearish stance as long as FII’s are pulling the money out of the markets. Year End rebalancing can further increase the intensity of Selloff.

In order for the Prices to turn bullish, we need to see some positive surprises and Price action must break the Resistance zone at 17600.

The Decreasing Volume in the last few days is indicating lower trading activity and declining order flow on the Index.

Right now we can notice a PB Setup in the Index Prices. When we saw a similar Price Action Pattern last time, Nifty fell almost 600 Points. What will happen this time? If similar behaviour take places, then we might see a break at the potential support zone around 17000 -16800.

In these types of market conditions, traders need to be careful and must trade only with proper risk management. Let’s keep an eye on the Price Action and take decisions accordingly.