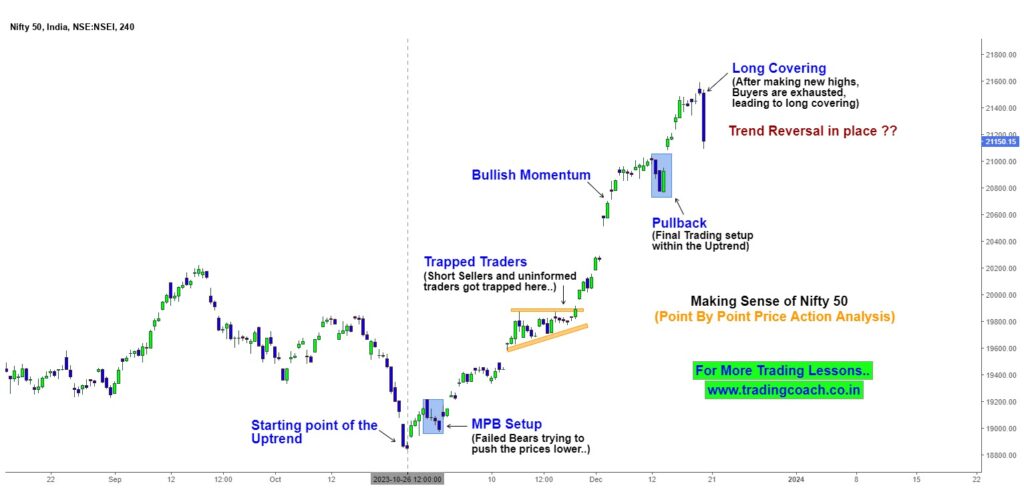

Here’s the Point by Point Price Action Analysis on Nifty 50 for the week, to make sense of the Price action outlook and big picture. Take a look at the chart analysis to understand the references and gather ideas

Nifty 50 Price Action Analysis on 4h Chart

1.Starting Point of the Uptrend:

Every uptrend has a beginning point —a pivotal moment where the market sentiment shifts, Identifying this starting point is crucial for traders seeking to trade high probability trend trading setups.

2. Failed Bears and the MPB Setup:

We can see the failed attempts in Nifty 50 of bears to push prices lower. The MPB setup aka Minor Pullback emerges when bearish attempt fails and leading to bullish upswings. It’s a strategic moment where smart traders recognize the potential starting stage of the uptrend.

3. Trapped Traders:

The short sellers and uninformed traders, faced the consequences of their misplaced trades. Recognizing these trapped positions becomes important for traders to find good trading opportunities.

4. Bullish Momentum

Bullish momentum signifies a surge in buying activity, higher highs, and confidence among investors. Price action indicates the positive market sentiment.

5. Last Pullback – The Final Trading Setup within the Uptrend:

Even in the most robust uptrends, Last pullbacks are the final move in the trend. Most likely trends could reverse after Last Pullback, leading to exhaustion and Long covering.

6. Long Covering:

After scaling to new highs, nifty 5 underwent long covering. Buyers, having exhausted their firepower, engage in covering their long positions. This lead to strong selling pressure in the market

7. Trend Reversal in Place on Nifty 50

Based on what we see right now, there are chances of Trend Reversal in Nifty 50. It could mark the end of an uptrend. This could signal a shift in the market sentiment. Look at the Sharp fall, that happened recently.

What’s next from here?

Just FYI, I am an individual trader, not a SEBI registered advisor, this article is for educational purpose only. I am sharing only my view. So do your own analysis and always take calculated risks.

There could be a reversal brewing in Nifty 50 and market might change the direction. But it all depends on the upcoming narrative and Price Action

Psychologically if market participants become more fearful, this fear could potentially mark the beginning of a new downtrend. (Just like the Intraday Price Action on Dec 20)

As a Trader, I will be looking forward to take a neutral to Bearish Bias

To learn more about Price Action Trading concepts and lessons I have discussed here, checkout the free course in the video given below

In order for me to change the bias from Bearish to bullish, I would like to see a strong upside swing and momentum in the price.