Here’s the Point by Point Price Action Analysis on Nifty 50 for the week, to make sense of the Price action outlook and big picture.

Take a look at the chart analysis to understand the references and gather ideas.

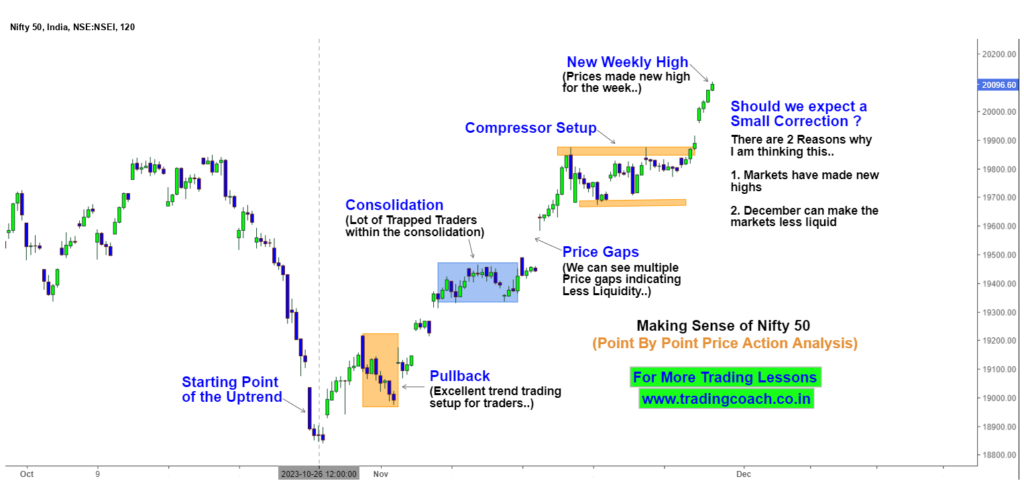

Nifty 50 Price Action Analysis on 2h Chart

1. Starting Point of Uptrend

This is the starting point of an uptrend. This pivotal moment marks the initiation of a potential opportunity for traders seeking profitable positions in the Nifty 50

2. Pullback – Excellent Trend Trading Setup for Traders

Experienced traders recognize pullbacks as excellent setups for trend trading. These pullback setups within the Uptrend allowed smart traders to position themselves strategically for capturing good upside gains.

3. Consolidation – Lot of Traders got trapped within Consolidation

Not every move in the Nifty 50 is straightforward. Consolidation phases can trap uninformed traders, creating a challenging environment. Recognizing the consolidation is essential for avoiding pitfalls and trading the market with confidence.

4. Price Gaps – Multiple Price Gaps indicating less liquidity

A keen eye on price gaps is crucial. Multiple gaps can indicate a market with less liquidity, potentially impacting the order flow. Traders can trade based on these gaps and adjust their strategies accordingly.

5. Compressor Setup

A lesser-known but powerful setup in a trader’s arsenal is the compressor setup. Recognizing compressor patterns in the market can help to capture high probability breakout or breakdown scenarios.

6. New Weekly High

Nifty 50 have made new weekly highs. Seasoned traders understand that this euphoria must be tempered with caution, as it could signal a potential shift in market dynamics and sentiment.

What’s next from here?

Just FYI, I am an individual trader, not a SEBI registered advisor, this article is for educational purpose only. I am sharing only my view. So do your own analysis and always take calculated risks.

There are 2 compelling reasons why I am expecting a small correction…

Firstly, markets have made new highs, so this may lead to profit booking which could trigger a natural retracement or a small correction.

Secondly, December could create a period of reduced liquidity due to Year end rebalancing by big institutions and market players which could impact the market in a negative way.

To learn more about Price Action Trading concepts and lessons I have discussed here, checkout the free course in the video given below..

I am taking a neutral to slightly bearish view on the markets due to these reasons.