It feels like just now we are seeing the start of 2021; it’s already the Year End. Time really flies!! That means as a Trader we should prepare for more roller coaster ride in upcoming year.

Talking about the Performance of Nifty 50 in 2021, in a simple word we can describe as, excellent! Despite correcting for last couple of months, overall it has gained 21% since from the beginning of the year.

So how does the Price Action looks like as we are beginning the New Year 2022? As usual, take a look at my Price Action Analysis.

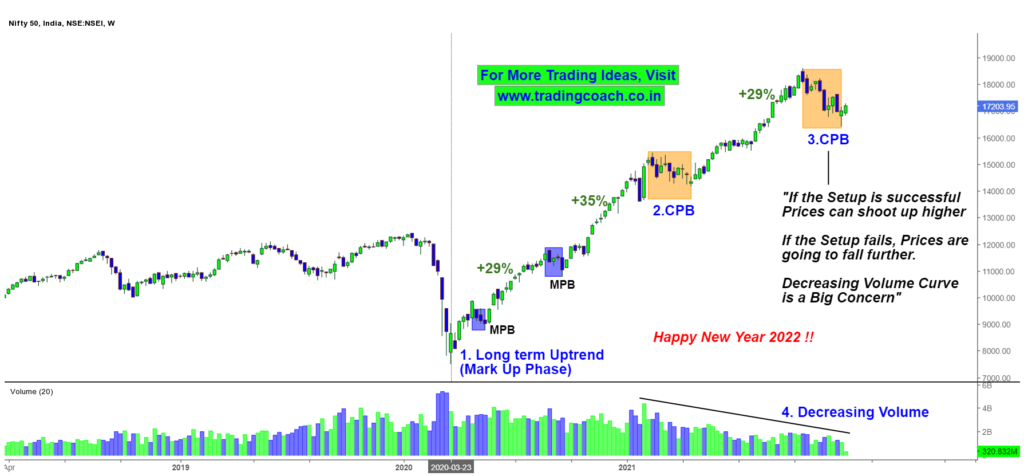

Nifty 50 Price Action Analysis on 1W Chart

The Long term Uptrend, which started in the year 2020, right after the Covid –19 market crash is still intact in Nifty 50, we are not seeing any signs of reversal in Price Action.

However the Volume is consistently declining since the beginning of 2021, which is in fact a sign of concern. We need keep a close watch on this, going forward. (Checkout my video linked below to learn more about the Volume)

Right now we are seeing a CPB Setup, which is a trend continuation pattern. If the setup is successful, we will see extended buying pressure and as a result prices can shoot up and break the important resistance zone around 18600.

On the Other hand, if the Setup fails, selling pressure will continue to persist in the Index. The important support zone around 16500 will crack wide open.

So as we are beginning the New Year, we are also seeing the Inflection Point in Nifty. Traders should keep an eye on the Price Action in Weekly Timeframe and take positions with proper risk management. Respect the market sentiment and trade accordingly.

Hope the New Year brings prosperity for all Bulls and Bears!