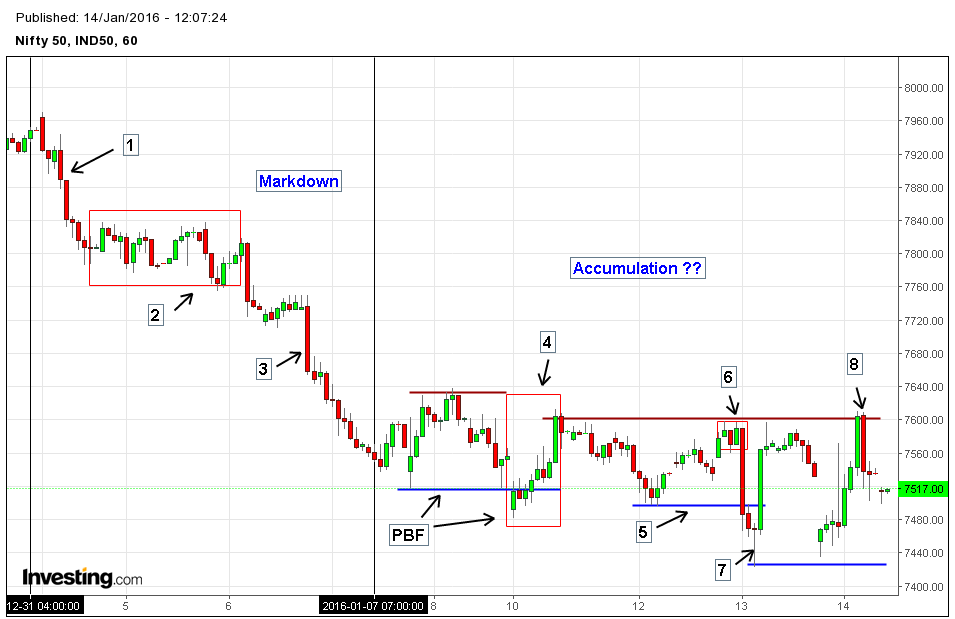

Chart illustrates some of my observation, which is marked by numbers. As some of my clients already know that, Nifty is in a Long term bearish corrective structure. This Price action analysis represents the short-term development of nifty in 1 hr chart, especially around structural level 7450.00. It’s also my first technical analysis update in 2016. I traced the price action – market psychology from Jan 2 2016, until Jan 14 2016 (Today). It’s presented below in numerical listing (as in the chart) for the purpose of simplicity and easy understanding.

1. Nifty started a selloff with influx of new selling pressure on Jan 2. This tells us that sellers are in control of price action; Generally speaking, Price behavior at first trading day of New Year is very important in gauging the market sentiment, perhaps it also validates our long-term view of bearish corrective structure.

2. Price action paused briefly around Jan 5 and rolled into a ranging market structure, which continued until Jan 6.

3. Large and aggressive bearish candlesticks indicated the bearish climatic movements, later turned into a structural trap to hunt weak players. This trap is seen as small candles which as usual followed the aggressive bearish candles.

4. On Jan 10, Nifty pointed out a PBF pattern (marked in red), which indicated the end of the downtrend. Precisely in Wyckoff terms, Failure to absorb the buying pressure, resulted in the beginning of a range bound structure.

5. Another test at support level around 7500.00. The rebound in price action indicated the conviction of buyers to defend the zone.

6. Sellers in turn defended their resistance level at 7600.00. Price action after the test of resistance resulted in strong bearish candlestick; it indicates the selling pressure at 7600.00 and above.

7. Another new low retraced back, which resulted in large bullish candlestick – it also marks the characteristics of accumulation. Buying pressure after every new lows, points out the strong presence of buyers at 7450.00.

8. Selling pressure again defended the 7600.00 zone with a strong bearish candlestick, indicating their presence.

In conclusion, this structure shows the existence of buyers at 7450.00 and the existence of sellers at 7600.00. A close inspection around the zones, show the strength of buyers, as they’re willing to pick up after new lows. There are two chances right now, either the accumulation will result in a uptrend or it becomes another failure. As long as the long-term structure is bearish, it’s hard for buying pressure to sustain. Watch for more price action clues, it might result in interesting trading opportunities.