Vaccine hopes are driving the Global markets higher. Despite lockdowns and economic constraints, Market Participants are highly optimistic about the Market returns. Most of the Risky assets are consistently rising in value. Even though the spotlight is falling on the Stocks, it’s also worth watching the Crude Oil. If there’s one instrument that’s going to get high demand benefit from things coming back to normal, it is Crude Oil. In fact, Crude Oil is already trending higher from last couple of weeks and currently testing the Resistance zone. Take a look at the Chart!

Price Action Analysis of Crude Oil

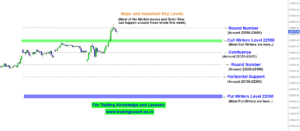

We can already notice a clear Uptrend in Crude Oil. Prices have rallied from 2500 and now trading closely around 3200. This entire trend itself is nothing but an Indication of shifting Market Sentiment. It simply reflects that Market participants are quite optimistic about the Oil prices and positioning themselves for the return back to normal.

But, in order for the Crude Oil prices to move higher, it should clearly break and retest the long-standing resistance at 3200. As you can see in the chart, right now it’s trading around the resistance zone. On the other hand, if we get any negative surprises, market sentiment can quickly turn pessimistic and prices could easily fall from the top. Keep an eye on the Price Action at the Resistance zone; we may get some significant trading opportunities on coming days.