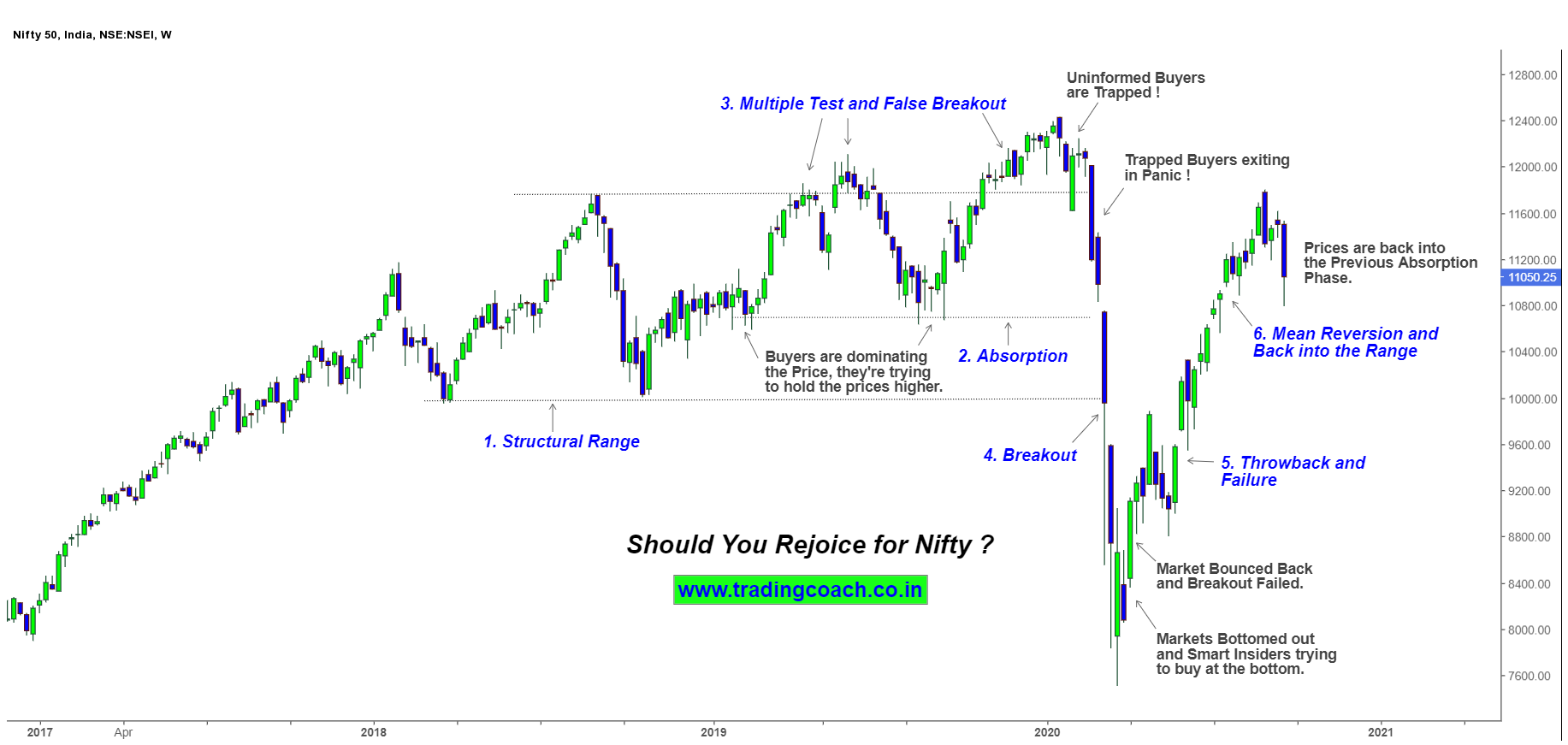

Here’s the Weekly Chart of Nifty 50. This chart shows the overall Big Picture of Nifty 50 Index. It’s almost 6 months since the Market crashed in March 2020, now it has almost recovered 75% from that steep decline. Prices have reverted back into the previous Range. Here’s where it gets interesting, maybe next couple of months, prices could stay within the range. After that, whichever side it’s going to breakout, either at Support or Resistance – a new trend might begin in that direction. It’s crucial for traders to keep an eye on this Chart to get a sense of big picture in Nifty 50.

Market Behavior Timeline

1. Structural Range

Nifty unfolded into a Range from the mid-2018, Major Support is at 10,000 and Major Resistance is at 11,750.

2. Buying Absorption

Buyers absorbed the Selling pressure and created a sub support at 10,800. It’s a clear sign of Buyers dominating the price, prior to market crash.

3. Multiple Test and False Breakout at Resistance

Prices made multiple attempts to break the major resistance at 11,750 and eventually ended with a false breakout, which might have trapped uninformed buyers.

4. Panic and Undershoot

Post Lockdown announcement, Panic sets in the Market, trapped buyers exited from their positions, the entire fall turned into a typical Crash. Prices broke below the major support zone 10,000 and tumbled all the way down to 7500.

5. Throwback and Failed Breakout

Eventually market hit the bottom at 7500 and bounced back. A classic case of throwback and failed breakout.

6. Mean Reversion and Back into the Range

The entire price movement mean reverted back into the range, precisely from where it all started. It’s now trading around the point of previous absorption phase.

Conclusion

As per my expectation, prices could stay within the boundaries of support and resistance for the next couple of months. At the same time, it’s also better to anticipate breakouts if any volatile events impact the market. Considering the strategy, traders should brace and lookout for Range bound trading setups. Finally to answer, it’s not yet time to rejoice for Nifty, unless and until we see a clear Breakout above the Resistance !

1 thought on “Price Action in Focus – Should You Rejoice for Nifty?”

very good articles