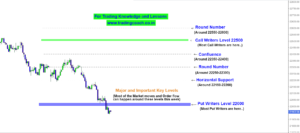

Reliance Industries is one of the few stocks that have benefitted majorly from the Covid crises. Drastic changes in the company’s business model, diversification from Energy segment to Retail segment are the two major themes driving the Price Action. However, from last couple of days we can witness a downtrend in Stock Prices; it’s a Short term downtrend. Prices have declined almost 22% from the peak value, even though it’s a drastic fall, still it’s not a good idea to take a short trade in Reliance, at least from my point of view! Here’s why – Take a look at this Chart Analysis

Price Action Analysis on Reliance Industries – 4h Chart

After testing the low of 1850, we can see a quick bounce back in Stock Prices. Along with that, volume has also significantly increased. Combination of Sudden increase in the Volume and a quick bounce back in stock prices, technically indicates the buying pressure on the stock.

But keep in mind, just because there is Buying pressure doesn’t mean that stock prices are going to shoot up. In order for the Buyers to take complete control over the market sentiment, Prices should break above the potential resistance at 2050 and must retest it clearly to go higher. On the other hand, a break below 1850 might push the stock prices into a further selloff or Sideways Behavior. Just keep an eye on the Price Action and Trade Accordingly in coming days.