As markets are trading in a state of utter confusion, FMCG and Safe heaven blue chip stocks seem to have rallied a lot in the last couple of weeks.

One of the Famous FMCG Stocks, Marico Ltd, has rallied around almost 12% since the beginning of July 2022. Stock prices have gone all the way from 480 to 520 and are currently trading around 528 at the time of writing this.

But for the past few days, we have noticed Bearish signs on the stock. Sellers are trying to stop the advance of buyers; we might get a potential reversal trading opportunity on this one…

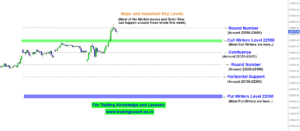

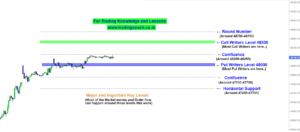

Take a look at the Price Action Analysis on 2h Time frame of Marico Ltd

Marico – Price Action Analysis on 2h Time frame

After testing the Resistance zone at 530, prices are creating sharp bearish candles indicating strong selling pressure on the stock.

If the Selling pressure sustains and prices continue to fall, then it can touch the major support zone at 500.

Overall, based on the recent price action, it looks like a good opportunity to short the stock. However, given the present market conditions, one must be a little cautious because of volatility.

There are chances our analysis could turn out to be wrong, if the prices break and close above 538. So if you’re planning to take position on this one, make sure to trade with proper risk management.

Keep an eye on the stock and take decisions accordingly. Checkout the Video given below to learn more about Price Action Analysis.