Well, Indian markets are experiencing volatility, likely due to fragile investor sentiment worldwide following concerns about a potential crisis in the Global financial sector.

The worries were compounded by news that Credit Suisse, one of Europe’s leading lenders, was facing difficulties. The uncertainty surrounding the financial sector led to a cautious approach from investors, resulting in Volatility of Indian share prices.

Due the volatility, the Nifty 50 index (.NSEI) was down by -0.90% at 16,945.50, and the S&P BSE Sensex fell by -0.87% to 57,492. Both benchmarks have experienced losses since their opening at the time of writing this content. This suggests investors are cautious due to the global concerns about the financial sector.

Traders and investors should keep an eye on the VIX (volatility index) in India, especially during these periods of market volatility.

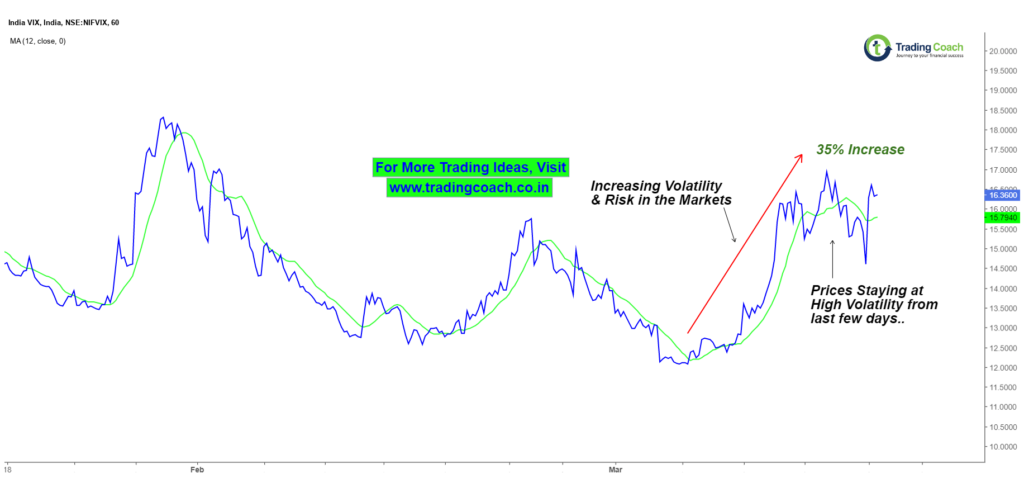

VIX – Showing Increased Market Volatility

The volatility index (.NIFVIX) in India surged to 16.31, which is the highest level since February 1st, which was the day of the union budget. The increase in the volatility index suggests that there is an increase in uncertainty and market risk, likely due to the concerns about the financial sector crisis and global investor sentiment.

Investors are likely to become more cautious, and the surge in the volatility index indicates a rise in bearish sentiment on the market.

Keep an eye on the VIX it can help you to make more informed trading decisions. For instance, during periods of high volatility, you may choose to stay out of the market or look for bearish trading setups.

On the other hand, during periods of low volatility, you may seek to take advantage of more stable market conditions and look for bullish trading opportunities.

To learn more about a Trading strategy that can help you to take advantage of Volatile market conditions, take a look at the Video lesson given below. Overall using VIX can help traders to make excellent trading decisions in line with market volatility and Risk.