Market sentiment

RELATED postS

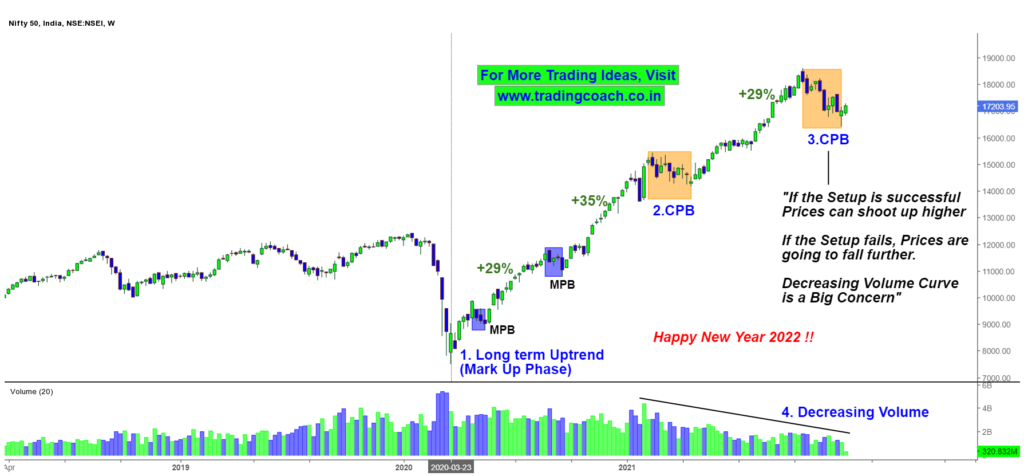

From last couple of weeks I am receiving multiple messages from readers and clients, enquiring about the status of Financial Markets, not just related

Coronavirus is one of the Biggest Black swan of the year. It unexpectedly shook the Financial Markets and affected the sentiment of Market Participants

Most of us know that Yes Bank Share prices are actually in a downtrend from last 1 – 2 Years. Despite improving fundamentals and

Stock market is a beautiful combination of Irrationality and wisdom of the crowd. Sometimes markets foresee what’s about to come and reacts to it