One of the Godfathers of Technical analyses Charles Dow prudently stated “Pride of opinion has been responsible for the downfall of more men on Watt Street than any other factor.”

Charles is the proponent of Dow Theory and the one who provided a basic foundation for technical analysis. Anyone who has seen traders and investors in action will know the real value of this statement, and the substantial merit it poses. Pride of opinion and prejudice in thinking means stubbornness and the inability to admit a mistake. In most of life’s timeline, this attitude can obstruct relationships and the achievement of specific goals. In the Trader’s life, such dogmatism is a recipe for disaster. Read about Charles Dow here…

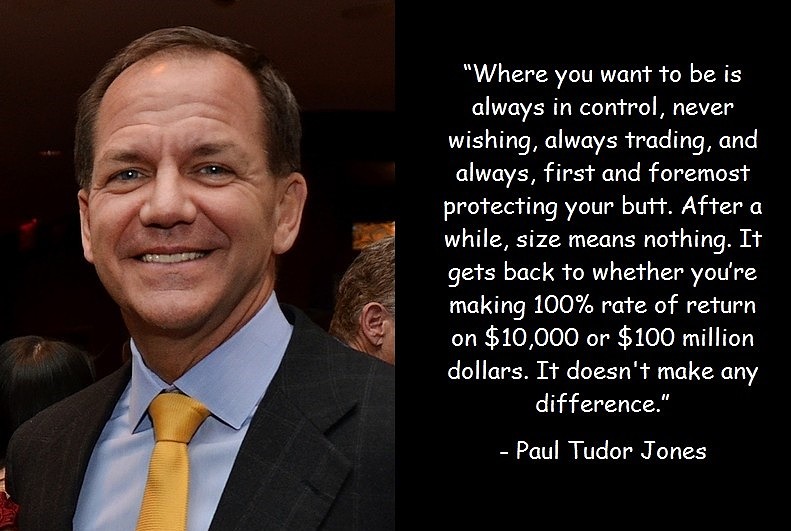

After a long winning streak, almost every investor and trader falls into the trap of thinking that he is infallible. Unfortunately, the market has a way of exposing this weakness, and often a long run of success is wiped out in a fraction of the time. Overconfidence and enthusiasm creates laziness and carelessness leading to poor market judgment and an inappropriate amount of Risk taking behavior. It’s a human tendency to feel dominant and heroic to take on more risk after a run of success. Remarking this attribute legendary hedge fund manager, Paul Tudor Jones famously quoted “Never be a hero, never have an ego”.

Pride of opinion create problems and brings destruction to a peaceful mind. Like, when markets are falling, dogmatic investors will often insist on maintaining their positions, even though the actual evidence of price action shows that facts have changed. A person’s ability to modify an opinion after conditions are altered was noted as a key determinant in judging his trading career in the Financial Markets. Anyone who holds strong views in total falsity to what is actually going on around him will certainly run into trouble. Recent views on Nifty and Bank nifty is simply the same set of pride and prejudiced opinions, I heard voices calling bottoms and tops without taking the actual reality into consideration. Self directed Individual trader will survive these noisy market calls. But you can imagine the scenarios of masses, which depends on tips and experts.

To read about my recent price action analysis on Nifty click here