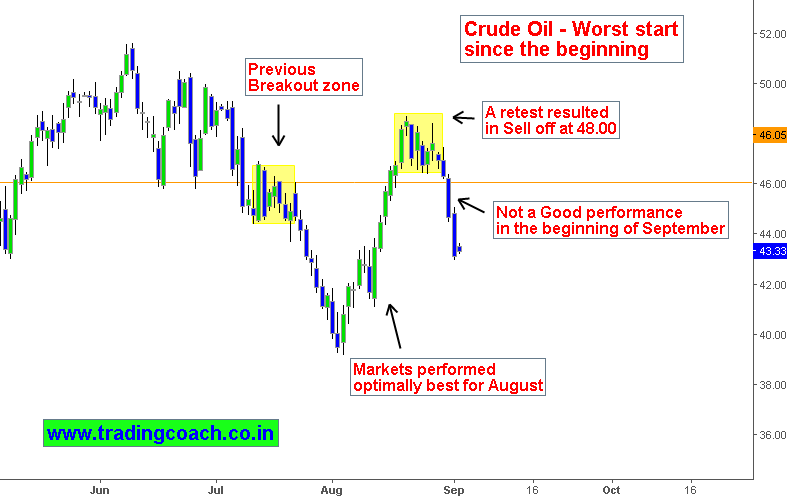

Crude Oil performed optimally best during the August, but the beginning of September is not as sweet as expected by oil bulls and commodity traders. During the week Crude oil took out three-week support level, setting up for the biggest weekly decline since January. The price action reacted on Wednesday after EIA reported a bigger than expected build in Inventories, sparking supply concerns. If we see constant weakness of buying pressure – Prices might continue to fall further.

Crude Oil Selloff in the Beginning of September

After Energy Information Administration reported a rise in US Inventories, Oil sold off sharply taking down the support level at 46.50. Stock piles grew by 2.3 million barrels, since the expected forecast was nearly 1.1 million barrels. Following the comments from Russia’s energy minister who repeatedly showed less conviction on OPEC meeting, Oil reacted instantly with further selling pressure. In terms of technical analysis, Price action retested the earlier breakout zone at 48.00 resulting in tactical sell off.

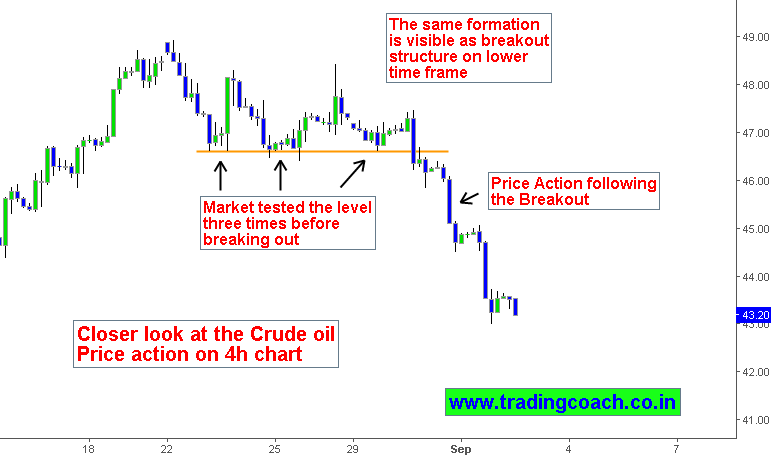

Crude Oil Technical Analysis: Breakout Structure on Lower Timeframe

Observing the Price action on Lower time frame reveals the market structure in Crude oil clearly. The formation is visible as breakout structure. Recent movements are connected to events, reports from supply side. Comments from Russia add further worries about price stability causing pessimistic attitude towards the asset. September gave the worst start for crude oil setting up for biggest weekly decline since January. Traders should keep an eye on US production levels and OPEC related news events which will impact sentiment of Market participants. Also observe the weakness and strength of buying pressure to capture trading setups.