This article focuses on Inter-relationship between Market structure and Price action patterns. Explains how price action patterns are found from reading market structure. Finally, it covers few core Price action patterns and how variety of other patterns and trading setups are found.

In the last article, I covered the topic of Price action swing analysis. Foundation of swing analysis consists of identifying inflective pivots. Before you read the article, I suggest going through Analyzing Market structure with Price action swing analysis

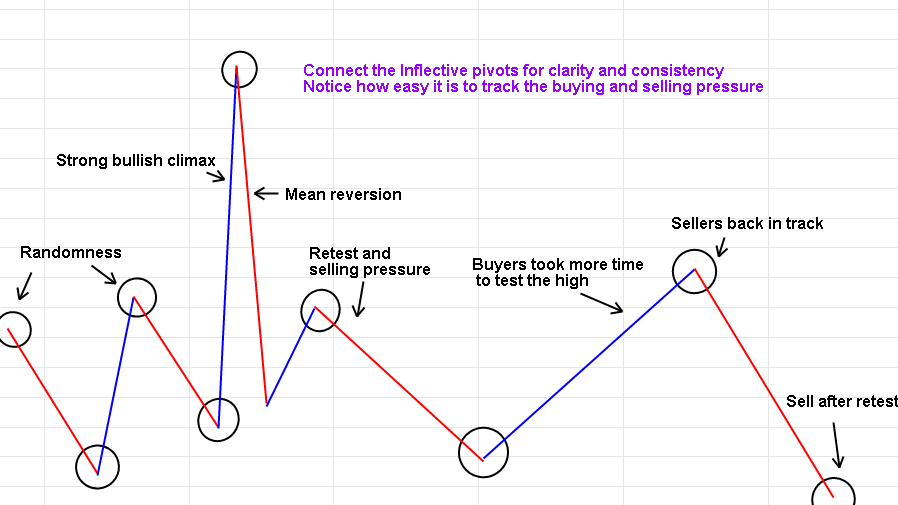

EXAMPLE OF SWING ANALYSIS

My clients know that, I always seek clarity and consistency. Trading is a probability business; traders are forced to make decisions based on asymmetry and inconsistency. We should have a high statistical edge to survive the odds of failure. Consistency and clarity helps us to accomplish trading edge. This is the reason, we seek Price action patterns. Price action patterns give consistency and clarity for traders. Remember, as a price action trader, we don’t trade pure patterns. Rather our focus is on buying and selling pressure that creates these patterns. Trading purely on patterns is a blind game, there is no difference between pattern trading and gambling. Market action is the fundamental source of focus for price action traders.

HOW TO IDENTIFY PRICE ACTION PATTERNS THROUGH SWING ANALYSIS?

To understand market action of buying and selling pressure, you need to analyze market structure. When we launch a critical analysis of market structure, we’ll be able to see some core price action patterns. These patterns are nothing but, shades of buying and selling pressure. Price action patterns provide a systematic edge in fine tuning our entries and exits.

IMPORTANT CONCEPTS OF SWING ANALYSIS

The core analytical concepts of price action swing analysis are :

1) When buying pressure is stronger than the selling pressure, upswings will be stronger and larger than downswings. 2) When selling pressure is stronger than the buying pressure, downswings will be stronger than the upswings. 3) Support and resistance levels are visible as ranging levels and zones. 4) When the price action is in equilibrium, there’s no clear pattern to the swings.

COMMON PATTERNS WHICH ARE FOUND THROUGH SWING ANALYSIS

There is nothing odd about price action patterns or setups. They’re all formed due to buying and selling pressure. There are some core price action patterns, which offer foundation for most significant trading strategies. Here is a small introduction of common price action patterns which are found through swing analysis.

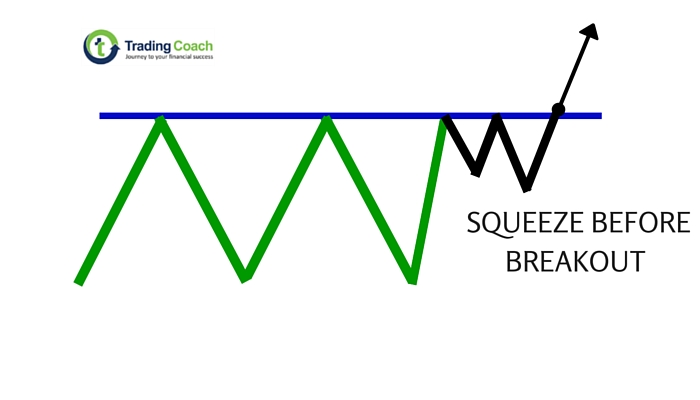

BREAKOUT SQUEEZE ON RESISTANCE

This picture shows an example of a breakout squeeze pattern on resistance; these patterns are often visible during the phases of accumulation. It suggests one of two things: On one hand this move is nothing more than a sudden spike caused by random liquidity pressure. On the other hand, it could be an early warning that buying pressure is taking control and it is possible that price action might trend higher from this point.

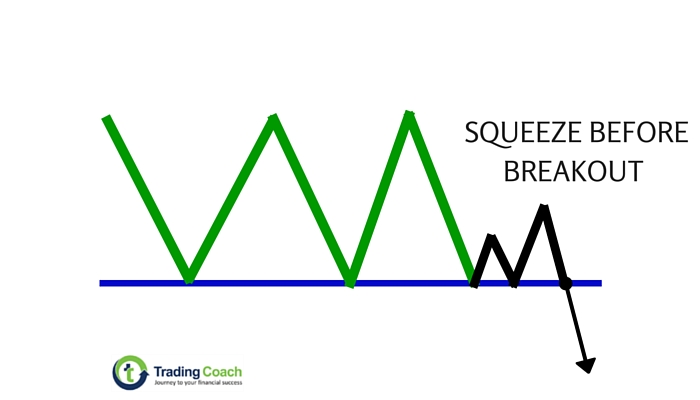

BREAKOUT SQUEEZE ON SUPPORT

This is an example of breakout squeeze pattern on support. These patterns are visible during the phases of distribution. The logic of this pattern is exactly opposite to the earlier pattern, mentioned above.

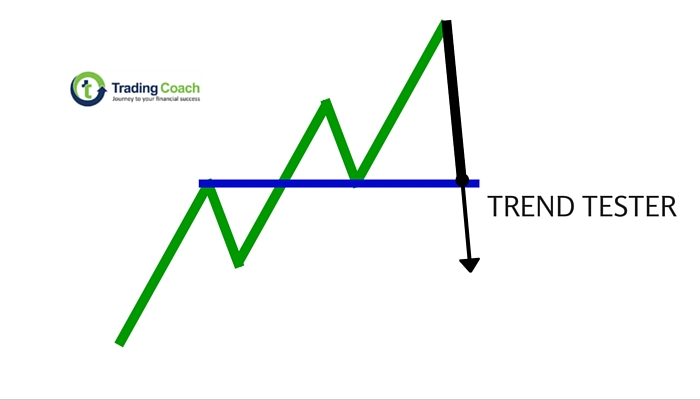

TREND TESTER

I refer to this pattern as Trend tester, as the name suggests these patterns test the strength of the trend. This is often first step of a trend change, but it’s quite hard to trade this pattern. It’s a warning sign that trend is becoming weak. Trend tester can cause a potential change in buying and selling pressure.

BOTTOM LINE

The article is not a complete book of swing patterns, but it does highlight the important concept behind swing analysis and market structure. Critical analysis of Market structure and swings can offer insights into buying and selling pressure. It helps an efficient chart reader to find core Price action patterns.