Lot of Hype surrounds the term Price action trading, because not all Price action traders approach the markets in a same way. In this article, I will share some insights about Trading Nifty using only Price action strategy. Before that let us de-clutter the meaning of Price Action.

In a real sense Price action trading is an umbrella term that incorporates trading strategies such as Tape reading, Volume Analysis, Range trading, Trend trading etc. It is primarily used by institutional traders where algorithmic trading is not employed. Since the approach ignores fundamental analysis and considers value in Price history – it’s considered as a part of Technical Analysis.

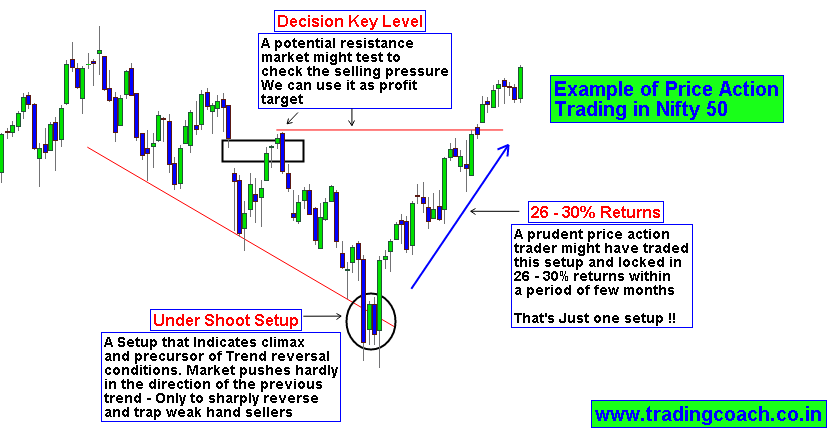

An Example of Price Action Trading in Nifty

As you can see the chart of Nifty 50 listed above, Price action trading involves reading the behavior of other market participants through the price movement and making decisions based on it. In a simple sense, we understand intentions of other traders (especially Big money players) and profit from their actions.

A common example for such kind of trading strategy is Breakout Failure. To know the mechanisms of Breakout failure, please read my earlier article on false breakouts. In a nutshell, Breakout failure is a price pattern that traps weak hand players (such as retail traders) who took trades anticipating a breakout. This breakout failure is an intentional activity of Institutional traders, banks and deep pocket investors to get better price for their positions.

Trading Nifty Using Quasimodo Price Action Strategy

Now, we have a better understanding of Definition and general picture on how to approach the markets using Price action. Let’s move on to the main topic, Using Price action strategy to trade Nifty 50. Here, we’ll use a price action setup known as Quasimodo Pattern as an example.

To know the mechanics of Quasimodo Pattern – Kindly go through my earlier article on Trapped traders

There are three reasons for choosing this setup:-

1. It’s pretty simple to trade price action using Quasimodo pattern

2. It doesn’t need much experience to trade

3. It works pretty often on Nifty in most market conditions

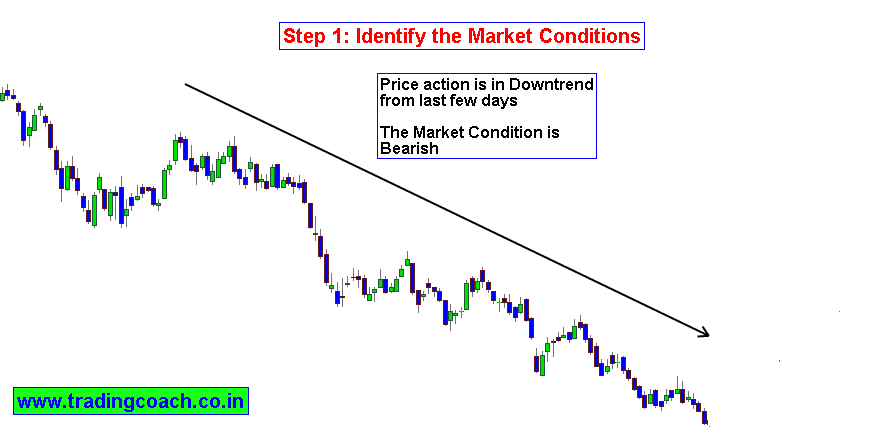

Step 1: Identify the Market Conditions, Scenarios Using Higher Time Frame Charts

Observation is very important in this step, look at the present conditions and note what is happening with price action. Note important details like whether prices are in a trend, range or in-between etc. You can use Indicators to highlight the current market conditions, but keep it simple. (Don’t use them for trading signals). Always use 4h, Daily chart (Day trading, Swing trading) or Weekly chart (Positional Trading) to find market conditions.

Whenever you approach the charts, price action will be in either one of these conditions

1. Trending – Making higher highs (Uptrend) or Making Lower lows (Downtrend)

2. Ranging – Oscillates back and forth without any clear direction

3. Evolving from Range to Trend – Prices will start trending after breaking out of a Range

4. Evolving from Trend to Range – Prices move into a directionless range from a trend

5. Moving from Trend to Opposite Trend – Trend Reversal conditions

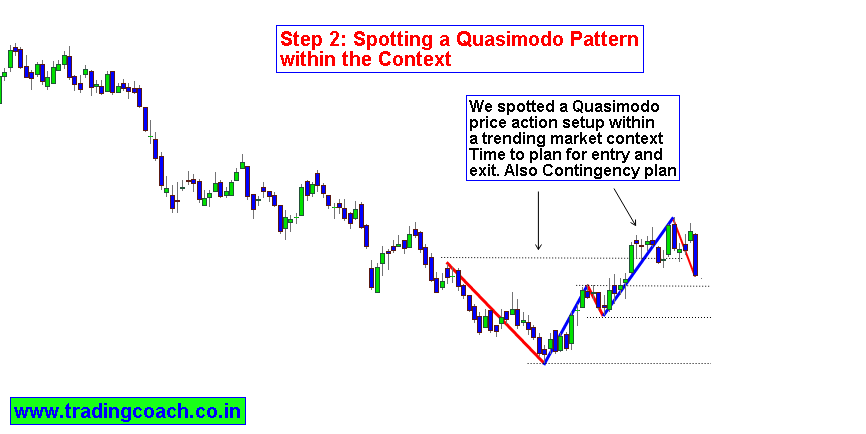

Step 2: Look for Quasimodo Pattern within the Context of Trend or When Prices Evolve from Range to Trend

Quasimodo pattern will be successful only in Trends and when prices move from range to trend. The context of appearance is very important because we are not trading patterns, instead we are trading the buying – selling pressure that creates these patterns. Their validity depends on Market conditions. If the same Quasimodo pattern appears in a range bound context, it will likely be a failure. Always remember, Price action trading requires analytical mind and flexible thought process. Make sure you catch the setup at the right place.

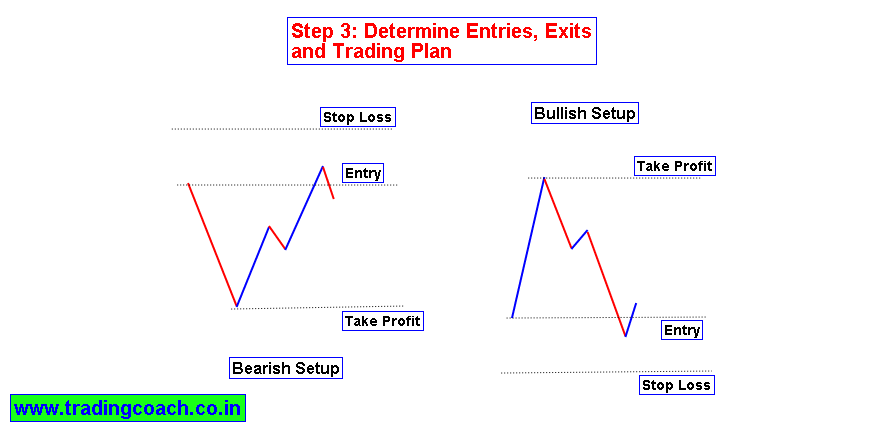

Step 3: Determine Entries, Exits and Trading Plan

The diagram gives a better illustration on structuring our entries and exits in Quasimodo Price action strategy on Nifty. These are traditional entry and exit plans; you can modify them if necessary. But make sure the risk: reward is more than 1:2; the rule helps in filtering out good trades from bad trades. Monitor the trade and exit partially if you see any indications of pattern failure.

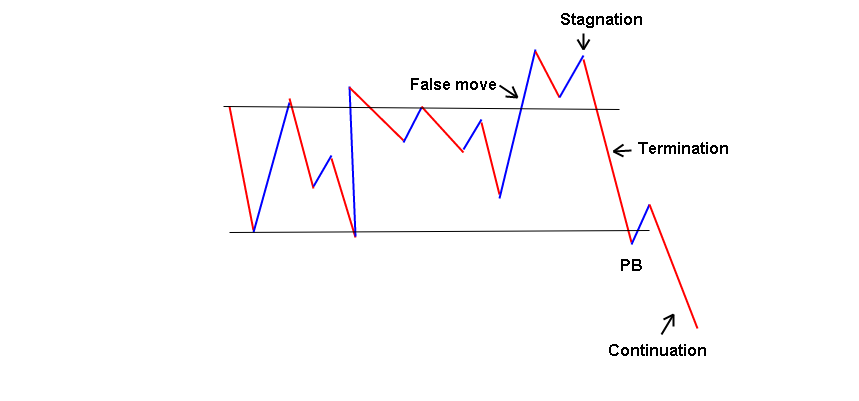

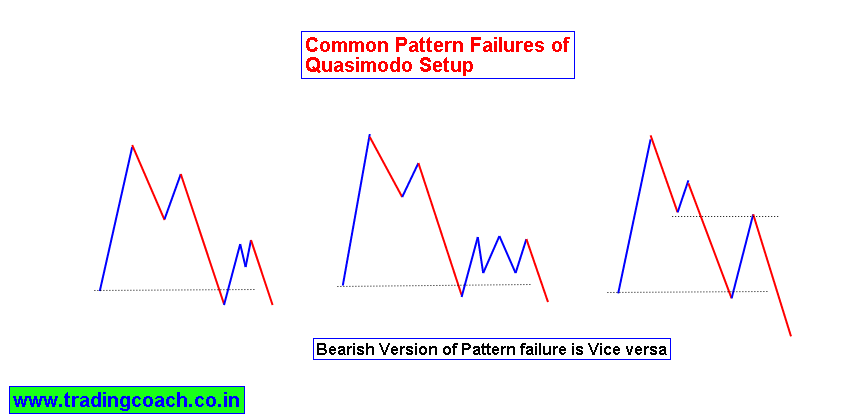

The diagram above shows some common ways Quasimodo pattern can fail. At any time, it’s necessary to have a trading edge; with price action trading, the edge comes from discretionary trade management and trader’s intuition.

We can trade Nifty using other Price action strategies in a similar way. The trading success with price action method depends on understanding the Market conditions precisely. It combines both systematic and discretionary trading methods. It’s a skill that any aspiring trader can learn. Price action trading does offer the potential to make handsome profits, but traders should also be aware that it takes practice to master it. It is up to the individual trader to understand, select, test, decide and act.