Trapped traders are those who are struck in the market after they got into the wrong side of the trade. These traders might suffer an emotional shock due to the loss they incur. But, if we closely watch their steps, we can reap profits out of it. In other words, these exiting traders help us to earn a fortune. This idea was initially put forward by our genius trader Richard Wyckoff. Here, he said, that if we follow the patterns created by these trapped traders, perhaps, it will aid us to make money.

How do Traders get Trapped and How They Behave

There are trapped traders who get caught in losing positions and some others chase the winning trades. If traders are trapped in a losing position, they have to exit trades to avoid further losses. On the flip side, those who are caught up in the winning position, unconsciously watch market movements and run after it to start making profits. This is because when prices come down to their stop-loss levels, they make a move to exit the trades. Suddenly, when price moves again in the expected direction or towards target level, they run after it. These traders “chase the trades” instead of capturing them.

3 Price Action Trading Strategies to Profit from Trapped Traders

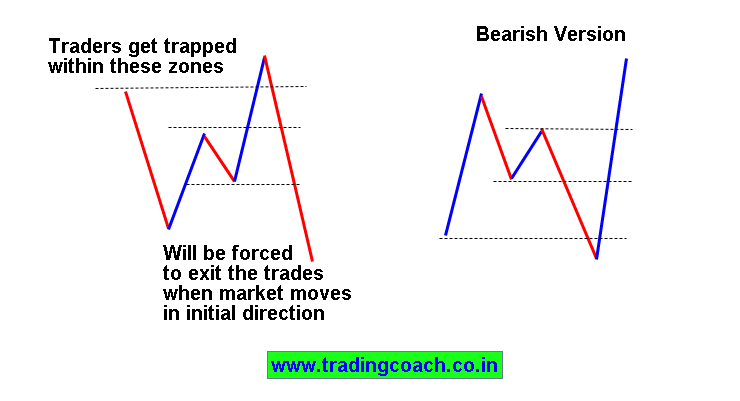

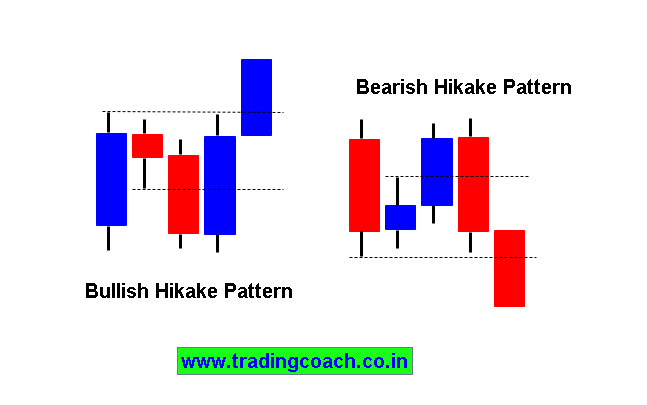

1. Quasimodo Trading Setup

This is a strategy in which the Price Action traders step into the trade when trapped traders begin to make a loss in the market. Quasimodo pattern in technical analysis clearly helps traders understand the market sentiment during last movement in time. Short term variation of this pattern is known as Hikake formation where candlestick bars are drawn to indicate bullish and bearish swings in the market. It is a group of 5 candle sticks in a particular range, where price action traders look out for failure of inside bar. At this point, trapped trader’s exit and Hikkake pattern traders enter the market. The more trapped trader’s exit, the better for Hikkake pattern. In Long term perspective the same pattern is known as Quasimodo.

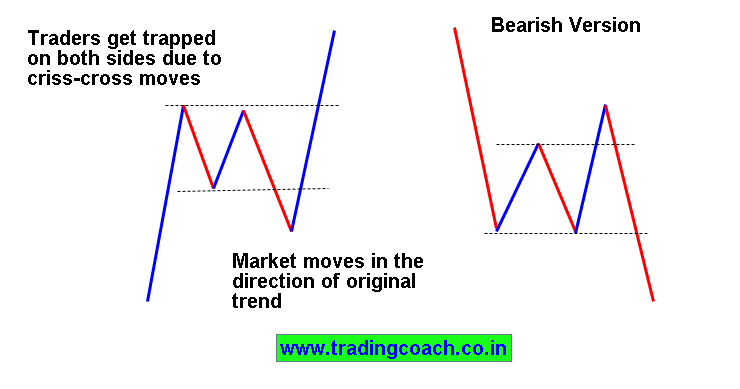

2. Two legged corrections

Two legged corrections, also known as complex pullbacks are frequently occurring trapped trader patterns in trending market. Before moving with Actual trend’s direction, price action retraces or consolidates eventually trapping weak hand players on both sides. When two groups of traders are trapped, they’re forced to exit trades and market moves in the direction of established trend, smart money players consistently make profits out of this setup.

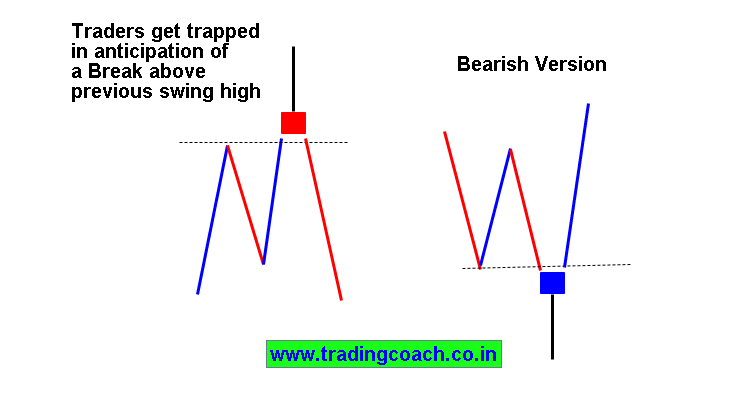

3. Pinocchio Bar Strategy

Pin bar is one of the most well-known Price action patterns in trading community. Yet, only very few traders know the market dynamics behind pin bars. It traps traders by going beyond previous swing highs or swing lows and closing instantly below it known as Price rejection. The longer the tail (Candlestick wick or shadow) of the bar, the better because it indicates the wrong movement which has prevailed in the market. If the candlestick tail goes beyond the major price levels and rejects back, it means that traders entering and leaving the market in large. This is an enormous opportunity for smart traders to get profit from.

In short, there are many price action trading strategies that use the concept of trapped traders, it is not necessary to make a list of all. The key idea is to think from the perspective of a trapped trader to understand the market psychology and dynamics. It is common for many of us to get trapped in the market at some time (including both professional and aspiring traders). So, learn from that and create your own strategy based on them. In my trading course I cover in and outs of successfully trading trapped price action patterns. My course also includes, many interesting trading strategies similar to this. To know more about my course check it out here…