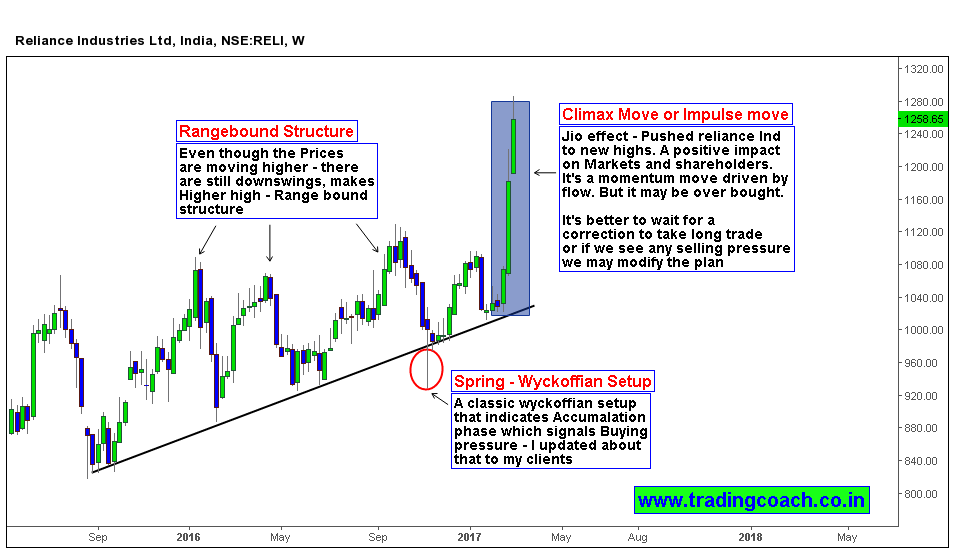

Reliance Industries (RELI) stock prices made new highs after a breakout from key resistance level at 1150.00 on Mid February. When we analyze the Price action that preceded the breakout, it’s obvious to notice the impulsive behavior and high volume movement. Though long term fundamentals are good for Reliance (especially due to Jio effect), the Intermediate price action seems a bit exhausted and overbought. There are possibilities of a correction or Pullbacks.

From the perspective of Risk: Reward, jumping into the overcrowded long trade doesn’t seem to be a viable option for speculators. It’s better to wait for a correction or some dips. The primary reason for enthusiasm on RELI is due to Jio. It’s a positive impact on shareholders and Investors which in turn drove the prices higher. But the real test is when Jio unveils its pricing plans and ends the free data plan that’s in play. If large percentage of free subscribers doesn’t convert into premium consumers then RELI will experience a large setback. So the judgment day is not yet there!

So it’s better to wait for a correction and keep an eye on the reality of consequences, when free Jio effect ends. Our thesis is to take long trade after a correction, but if we see a strong selling pressure then we may modify our trading plan