Some Major fundamental factors are changing in Hathway, the biggest digital cable TV and broadband internet services provider in India, which can impact the share prices. Considering the latest Broadband business in India their services are at an inflection mark. Compelling competitors are entering the industry rapidly resulting in tough competition for major leading broadband service provider like Hathway Cable and Datacom.

Growing Data Consumption but declining Broad band Business

As data consumption is growing in India rapidly, though data service providers have a great scope in the coming days to reach huge heights, Rising Competition and cheaper Data Packages from Telecom operators such as Jio, Airtel and other major telecom companies is impacting the Potential of Broad Band business.

Telecom Sector Cheap Data Services affecting Hathway’s Broad band Business

According to the recent Report, Data consumption in India has increased to 27.3 percent in October 2017 from 15.9 percent in September 2016, converting a net addition of 15.3 million subscribers. But with this rise, we can also see a major broadband business of hathway cable moving towards a downfall.

Mukesh Ambani’s Reliance Jio telecom is the highest beneficiary of the changing Broadband business. Following to one of the research conducted by Citi in Dec 2017, the broadband subscriber base of telecom companies grew by 15 mn as of October 2017, with Jio leading the pack with 7.3mn new subscribers, followed by Bharti Airtel (4.6 mn) and the Idea-Vodafone combine (3.9 mn).

High Debt to Equity Ratio is also a Concern

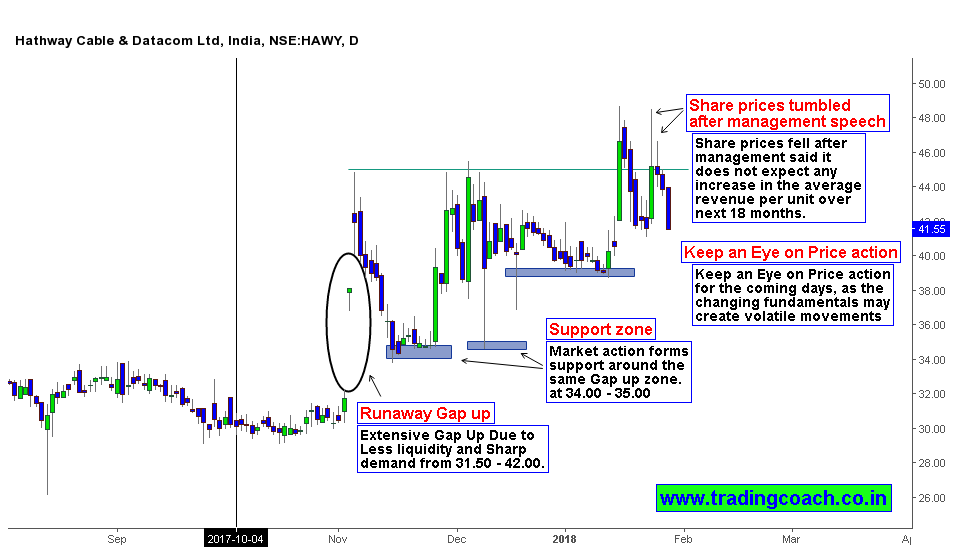

Hathway Cable and datacom’s major revenue comes from wire connected Broadband business. It holds 52 percent share of the total MSO cable broadband market in India. But as the consumer base is shifting towards telecom data service providers, Hathway’s management does not expect any increase in the average revenue per unit over the next 18 months, which is technically a Bad news for share holders and Investors.

Also Hathway Cable stock experienced a decline of approx 43 percent of its market value, where at the same time the standard Nifty gained almost 32 percent. Apart from the above, the next major concern is the high net debt ratio. This has been on a steady rise as the high capital expenditure is greatly involved in the broadband business.

Given all these Fundamental factors, Market sentiment and Investors perception might change in Hathway Cable – Datacom Share prices. Investors with a Long term outlook on Hathway must consider these important things. Traders should keep an eye on higher time frame price action as sentiment shift can create volatile price swings and opportunities in the short-term.