Becoming a trader is a simple professional goal, but not an easy one! Aspiring traders go through lot of ups and downs; many give up in-between, while few survive the rough roads. One of the main problem for many traders (both experienced and novice) is that, they don’t pay attention to reality or do independent thinking. Taking this into consideration, this article sums up few realistic factors that you need to know, which many ignore.

Many Books are Overrated

Well, you can read some highly valuable books written by legends such as William O Neil, Richard Wyckoff etc… But they won’t get you too far. It doesn’t matter, how many books you read, you’ll soon realize they’ll offer same lessons in a different perspective and context. Many highly rated books in trading literature are nearly useless, if you just think for a while!

No Value in Basic Courses and Educational Programs

Most of the lengthy courses and educational programs cover nothing more than basic stuffs. These basic stuffs are not at all useful for professional traders. In real life, markets are more volatile – complex and need clear-cut risk management to make risk adjusted returns. Many retail traders, just blindly follow what they learn from these courses and soon they’ll realize the truth

Buy right – Sit tight and you’ll have sleepless nights

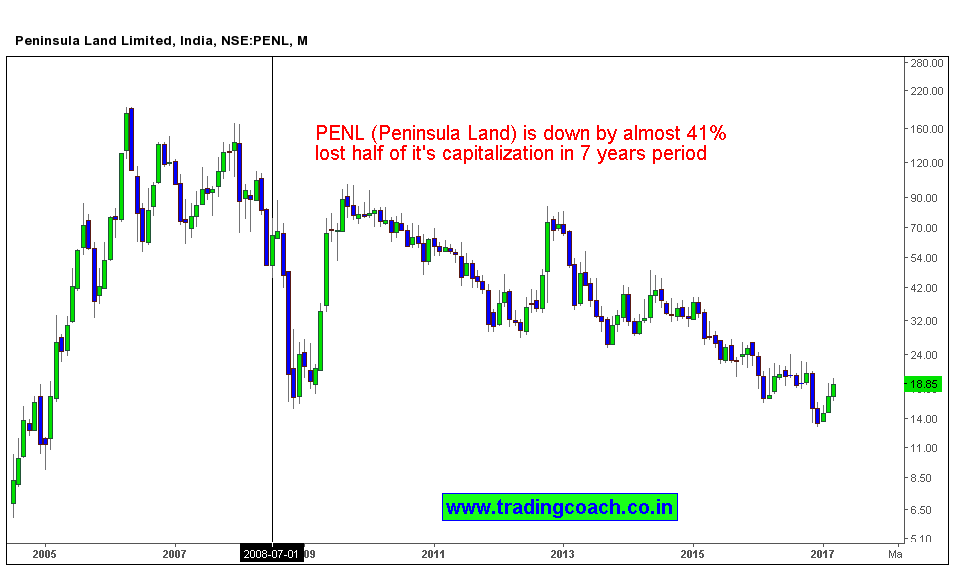

You’ll see many offer buy right – sit tight advice and they promise everything will go good. However, when you apply this – sooner or later, you’ll see your investments gradually lose value and time. Never listen to the crowd; these crowds are always wrong about everything. In times of a market crash, these so-called fundamentally good investments lose almost half of their value.,

Problem of Misinformation and Learning from Internet

Internet has more misinformation than knowledge; it was hard to get a grip on anything. There are many so-called gurus who don’t even trade a dime but offer so-called tips and courses. Of course, there are genuine teachers, but it’s hard to separate wheat from chaff. Anyone willing to be a successful trader must find a solution to not get bounded by misinformation.

How to be a Knowledgeable – successful Trader?

To be a successful trader one must have self-discipline, independent thinking and practical knowledge from experience to swim on the tide. Hardly any courses or educational programs offer it. So the best bet is to learn by yourself through practice or learn from a real life professional trader.

Learning by yourself may increase your learning curve, might take time. A true mentor can reduce your time consumption and learning curve, also help you avoid many mistakes which a trader is bound to make. A Practical trader can share his successful experience and trading strategies, which can help aspiring trader to be more consistent in his performance.

If you’re planning to learn by yourself, don’t waste time by reading and searching multiple systems and strategies. Instead learn what is necessary such as Risk management, probability and Simplistic – successful trading strategies. Put what you’ve learned to test and practice. Learn from your own experience and mistakes. Make sure you have a proper learning plan and goals.