Richard Wyckoff is one of the legendary traders in Wall street. Most of the traders associate him with VSA analysis or Tape reading. But as a fact, Richard Wyckoff is one of the god fathers of Price action trading and the first trader to intensively analyse volume with price movement. During his days, Richard Wyckoff was a well known stock market figure, founder and editor of the Magazine of Wall Street (founded it in 1907).

Earlier Days of Richard Wyckoff

Richard Wyckoff began his Wall Street career in 1888 (when he was 15 yrs old) as a stock runner. Wyckoff learned to trade stocks by watching other traders and their market activity directly. His first trade occurred in 1897 when he bought one share of St. Louis & San Francisco common stock. After successfully trading his own account for several years (around 25 yrs), he opened a brokerage house and started publishing research in 1909.

Wyckoff implemented his own methods in financial markets and grew his account enormously. His wealth and income history stands tall as a proof, that he is a successful market player. He is also an example of how a normal trader can make it to the top in this business.

As Wyckoff grew wealthier, he also became very altruistic. Soon he become an instructor and educated the public about Wall Street and its practices. In his later years he turned his attention and passion towards educating aspiring traders.

Richard Wyckoff and his Trading Style

Richard Wyckoff developed his understanding of the market behavior through conversations and interviews with master traders of his time. After a consistent period of success he publicized his trading approach in a specific set of principles and strategies to educate the general public.

Many novice traders referred only to a limited techniques of Wyckoff such as VSA and Tape reading. To be honest, He traded using multiple strategies and discretionary approaches based on what he referred as Market Logic. In a simple sense, Wyckoff created a method for understanding the buying and selling activity of large traders and Financial institutions through analyzing volume and price.

As per Richard Wyckoff, If a small trader could recognize the signs of big players in the market and if he can align his positions along with their activity and interests then he will have a better chance of succeeding in the markets. According to him, In the end it is the buying and selling activity of large players is what moves the markets.

Even though it’s very obvious in today’s market, this was a serious discovery during his period. Since most of the stock market instructors in his time such as WD Gann, Ralph Nelson Elliot, Edson Gould were preaching about patterns and cycles which were similar to astrology and Fiction, Richard Wyckoff took a different path altogether. His methods were based on pure and simple Logic of Market behavior.

Two Schools of Thought in Technical Analysis

There are two broad schools of thought in technical analysis. One approach is to track and categorize every possible chart patterns then trade them according to a certain set of rules. A trader using this approach might look for wedges, pennants, flags, boxes, head and shoulders, double bottoms etc. and would trade them based on pre-defined target and stop loss. In the earlier period, Edwards teamed up with John Magee and the two wrote Technical Analysis of Stock Trends which is now considered as a source on chart patterns.

The second school of technical analysis is based on Richard Wyckoff’s approach. The core concept here is that chart patterns have very limited utility, and what predictive power they do have is highly depends on where they appear. Wyckoff believed, real purpose of Technical analysis is to understand the market behavior. Many traders during his time found a richness and depth in the Wyckoff techniques, an approach that surpassed the simplistic focus on chart patterns.

Wyckoff Price Cycle and Market Logic

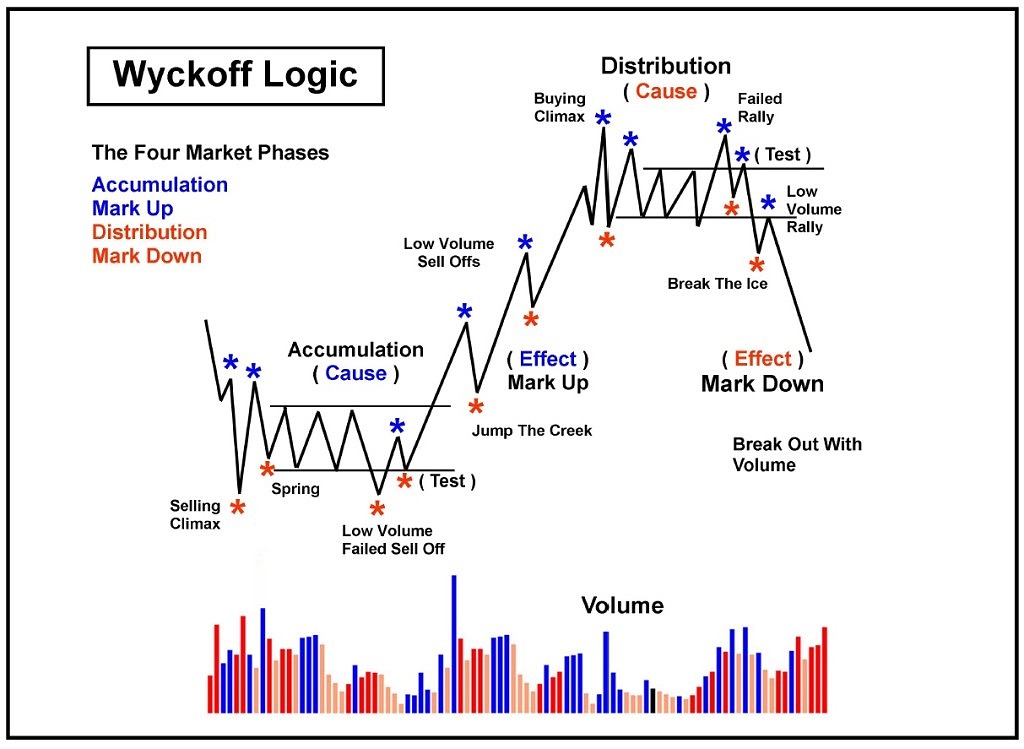

Richard Wyckoff had developed a theory related to the price action in the market. He referred it as ‘Market Logic’ which is still one of the leading principles for trading and investing. The Wyckoff’s Price Cycle states that, price action of any given stock trades in either one of these 4 stages at any point in time:

● Accumulation ● Markup ● Distribution ● Mark Down

Wyckoff used the Price Cycle to understand the price movements in the market. According to Wyckoff, the price cycle is caused by the activity of Big Players and large financial institutions. If the market participant performs a proper Analysis, he can recognize the current market cycle and will be able to take positions according to it. For eg. The end of an Accumulation stage is the beginning of the Markup stage, where you should look for Bullish opportunities. Likewise, the end of a Distribution stage is the beginning of a Markdown stage, where you should look for Bearish opportunities.

Wyckoff picked many winning stocks in his time using the approach. He analyzed the big players and their operations, and determined best risk – reward opportunities for trading. He emphasized the placement of stop-losses always, the importance of controlling the risk of any particular trade. Simply, Wyckoff felt that an experienced trader should read the story that appears on price action. He felt that it was an important psychological and tactical advantage to stay in harmony with price action.

From the perspective of Richard Wyckoff, to be a successful trader you need to understand the market’s mind. Doing so, would lead us to be a profitable trader.

1 thought on “Richard Wyckoff – A Genius Trader”

Have you ever considered about adding a little bit more than just your articles?

I mean, what you say is fundamental and everything.

Nevertheless think of if you added some great images or video clips to give

your posts more, “pop”! Your content is excellent but with images and videos, this website

could undeniably be one of the most beneficial in its niche.

Very good blog!