If you are a stock market participant, insider trading is one of the terms you will be familiar with. Insider trading is when an individual trades in the stocks using confidential information to their own advantage before the news becomes public. In general there are two types of insider trading:

1. Legal Insider Trading

Legal Insider Trading is when insiders mainly in form of directors, managers or employees trade their own company’s stock. For instance, let’s say the Chairman of Yes Bank buys 2,000 shares of Yes Bank. As per the Securities and Exchange Board of India (SEBI), this trade must be reported to the bank within two trading days of the transaction. The bank will further disclose this to the stock exchange in which the shares are listed.

2. Illegal Insider Trading

Illegal Insider Trading is when insiders have an access to important information which has not been released publicly such as company’s merger, new product launch or upcoming earnings report etc. Since all these factors significantly affect the company’s share price, such undisclosed information can be used by insiders to buy stocks at a cheaper rate or to manipulate the stock prices. Such kind of trades are neither documented nor reported to SEBI.

To better understand this let’s look at an example, an employee of Tata Power gets information regarding the company facing some financial issues. He knows that his friend owns large quantity of Tata Power shares and will bear some severe losses once the information gets out. So the employee warns his friend to sell the shares right away. (As per the regulations, this type of trades is strictly non ethical).

There is a fine line separating legal insider trading from illegal insider trading. In legal insider trading, insiders trade in their own company’s stock and report it to their corporation. In illegal insider trading, insiders trade in stocks using material non-public information for their own benefits without reporting it to concerned authorities.

Insider Trading – Why Traders should pay attention to it?

According to the famous investor Peter Lynch, “Insiders may sell shares for a number of reasons, but they buy them for only one reason; when they think the price will rise”. Insiders are well aware of their own industry and the particular company they are trading with. Insiders often trade using inside information that can have potential impact over the stock prices. By tracking the activity of Insiders you can figure out where a particular stock is headed and how its price action is likely to change in the nearest future.

As per SEBI, insiders who’re trading legally are supposed to disclose their trading activity. Based on regulations, the companies are required to report the insider holdings to the stock exchange on a regular basis.

How to Track Insider Trading in India?

Since the trading activities of insiders are publicly disclosed, one can easily track insider trading. I cover multiple ways to trade based on Insider holdings in my premium mentorship training. But for now, let’s look at 3 Different ways to track Insider Trading..

1. Insider Deals

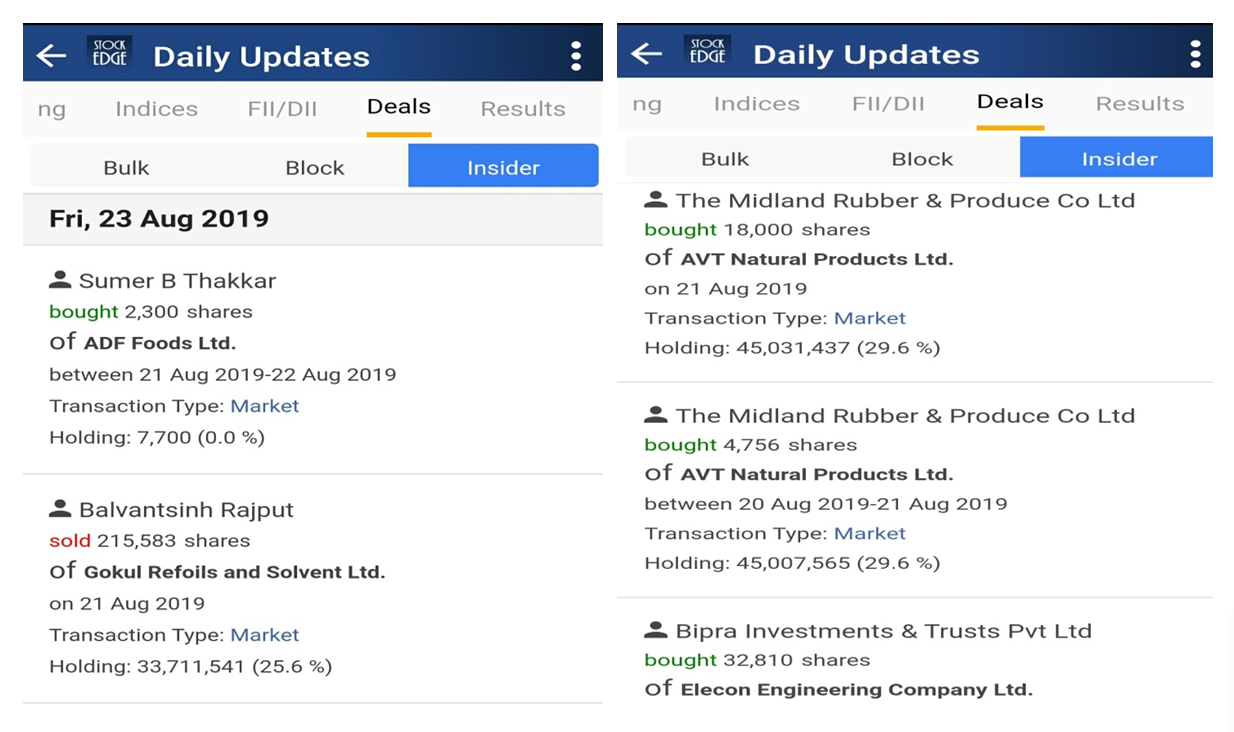

This is one of the simplest ways to track Insider Trading. Insider Activity Disclosures of the respective companies reported to the exchange are easily available either on the Bombay Stock Exchange (BSE) or National Stock Exchange (NSE) website as Insider Deals. An application like stock edge also gathers such comprehensive data and gives it in a neat visual format.

From the above images you can see various insider deals which have taken place on 23 August, 2019 in the Stock edge application. Insider deals like these will help you to track Insider trading activity on a regular basis in a particular stock.

2. FII / DII Activity

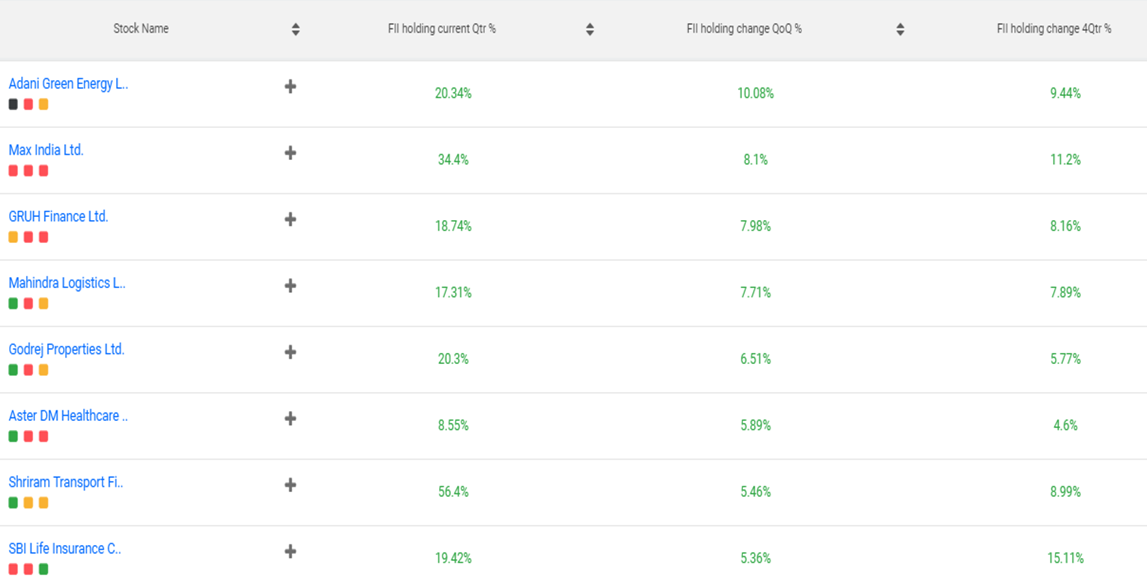

FII (Foreign Institutional Investors) and DII (Domestic Institutional Investors) Activity can also be considered as a proxy for Insider trading. Even though Institutional Investors are not considered as Insiders in a traditional sense, but they’re often well informed about a company than the general public. Hence tracking their holdings will give us a good insight about a particular stock.

The above image shows us the FII holdings in various stocks. The percentage holdings show us the overall portion of their holdings. When FII holdings are increasing, it means Foreign Institutional Investors are pretty confident about the company. On the other hand, if FII holdings are decreasing it could mean Foreign Institutional Investors are losing confidence in that company.

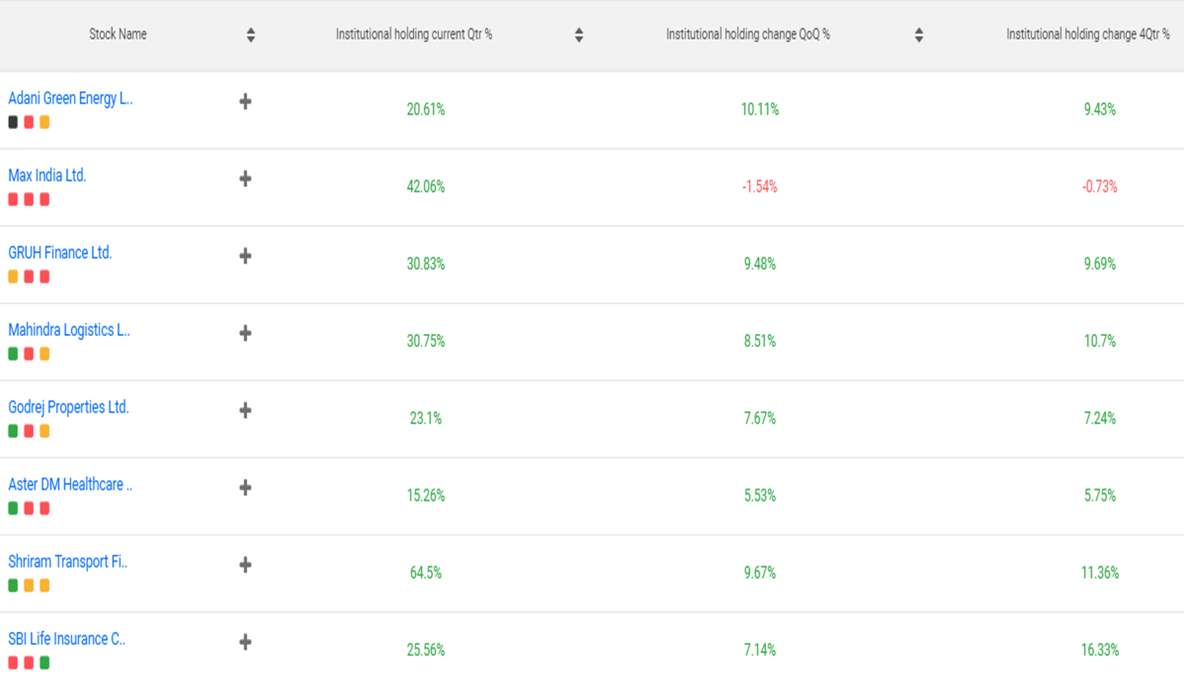

Similarly in the above image, you can see the DII holdings for various stocks. Increasing DII holdings means Domestic Institutional Investors are pretty confident about the company and decreasing DII holdings means Domestic Institutional Investors are losing confidence in that company.

Increasing FII/DII holdings could lead to an Uptrend in stock prices whereas decreasing FII/DII holdings could lead to a Downtrend in stock prices, most of the time.

3. Event Driven Price Action

One of the most classical ways to track down insider trading is through price action. Often times, Stock prices respond to major events such as Quarterly results, General Meeting, Monetary policy etc. But in some cases stock prices move sharply before an important event or an announcement becomes public. Such types of Price action scenarios are known as Event Driven Price Action, which can give hints about Insider trading activity.

For example, Reliance Industries recently announced that it will become a zero-net debt company in 18 months which had a positive impact on the investor sentiment. But five days before that announcement (on 8 August, 2019) there was a significant price rally. Take a look at the Price Action of Reliance Industries to get an idea of what I mean.

Possibly insiders who knew about this positive announcement executed their trades before the news was public. A day after the announcement, you can see another significant price move on 13 August, 2019.

So as a general rule of thumb, Insiders will have a good insight about a company than the general public. Tracking insider trading data can give traders a valuable outlook which can help to make informed trading decisions. But as usual, one must combine Price Action Trading Strategies with Insider Trading data to have an Edge.