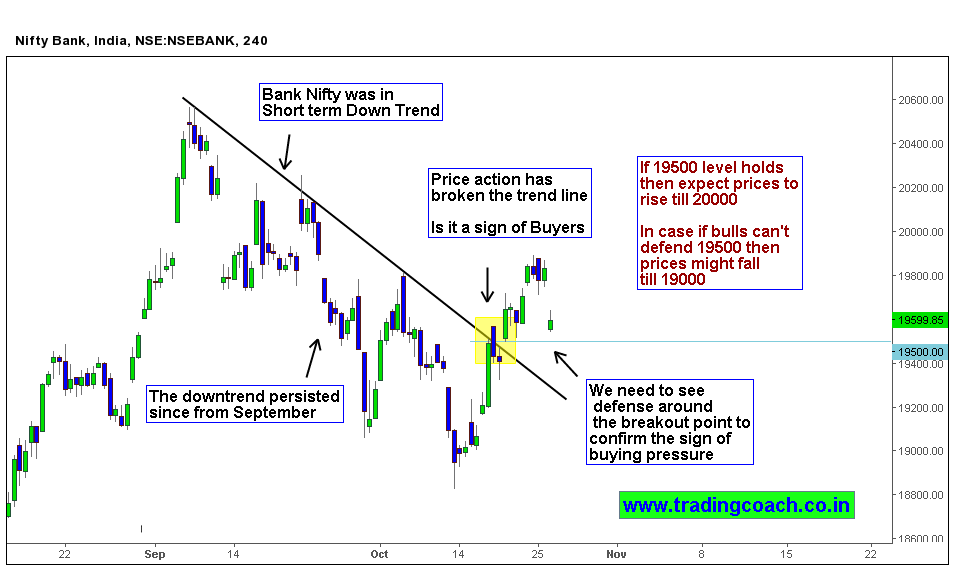

Despite lackluster fundamentals, banking sector stocks have performed poorly from early September till mid October because of corrective downtrend in Bank Nifty. The down trend line persisted from September and price action traded in respect to the trend line perfectly. But the prices rebounded as we near the end of October. Market took support at 19000 and eventually broke the bearish trend line which was intact since September. Traders should keenly watch the price action in bank nifty; it may offer some high probabilitical trading setups

Price action broke the trend line at trading intersection of 19500. It is necessary to decide whether the breakout is valid or not. As we move towards the Diwali occasion, sometimes seasonality factors may play a major role and influence the price action. Seasonal movements are naturally short living, so it makes sense to not give into the breakout at face value. To make sure that buying pressure is strong enough, we need to see retest around the breakout point 19500. Prices may test the breakout zone multiple times. We need to look for some strong defense by bulls to confirm their dominance..

Price action Trading thesis is in the 4 hr chart of Bank Nifty Listed above..