Trend lines are one of the most used and misused tools in modern technical analysis. One good working definition of a trend line is a line drawn between two points on a chart, but then the internal trend lines, which can be drawn anywhere through the middle of price bars. There are many possible variations of these lines, but the one rule is that however the trader chooses to define trend lines; they should be used and applied consistently. In this article, I am going to explain about different types of Trend lines and how it helps us in Trend analysis.

DIFFERENT TYPES OF TREND LINES

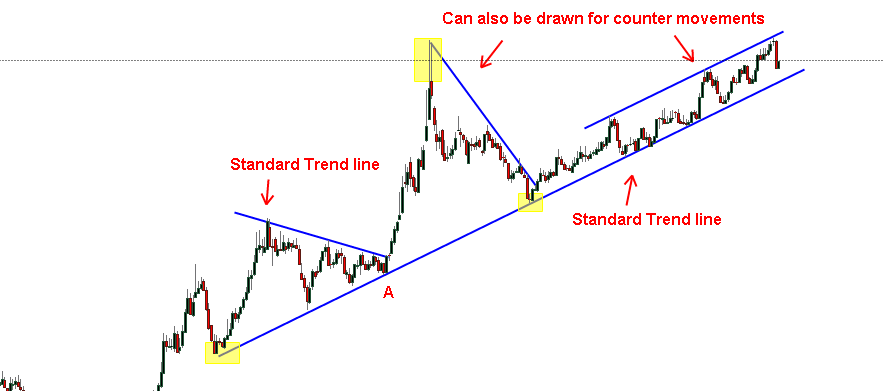

The Standard Trend Line: Standard uptrend lines are drawn between higher lows in an uptrend; the standard downtrend line is a line drawn between lower highs in a downtrend. The uptrend line shows where buyers have stepped in on the declines with more demand and have bid the market higher, which is why Wyckoff called this line the demand line. In a downtrend, the downtrend line, or the supply line, shows where more sellers have come into the market to arrest the bounces. If you are drawing standard trend lines, be certain of Price action terms.

Important points to keep in mind about Standard Trend lines

They are lines drawn between successive swings in the market. If there are no swings, there should be no trend line. Sometimes, it would be hard to argue whether the market was showing any swings. In such cases traders may or may not draw standard trend lines depending on personal preference. Trend lines are tools to define the relationship between swings, and are a complement to the simple length of swing analysis. As such, one of the requirements for drawing trend lines is that there must actually be swings in the market.

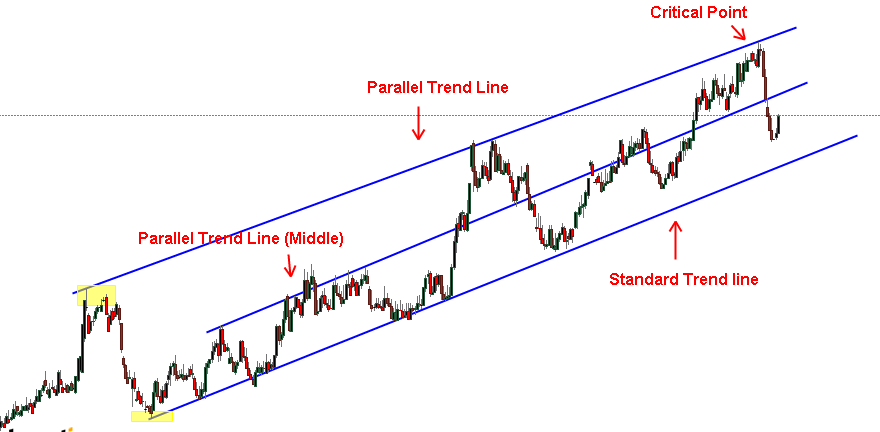

The Parallel Trend Line: The purpose of the parallel trend line is to create a trend channel that shows the range of fluctuations that the market has accepted as normal. In general, if you are long in an uptrend and prices rise to the upper parallel trend line, it probably makes sense to be slightly defensive and to take some profits. The same idea applies, inverted, to down trending markets. Of course, the market can take out the parallel channel and continue, but this is often an area where there is added volatility and heightened potential for reversal.

Important points to keep in mind about Parallel Trend lines

This parallel trend line is a good example of what people mean when they say “reading the market tape,” which is, in part, judging how the market acts around critical levels. A key part of this is price action on lower time frames. A complete understanding requires inspection of several lower time frame charts, and, ideally, monitoring in real-time as the action develops.Two expectations for price action near this line. In the first case, prices reach the top of the channel and pause or back off.

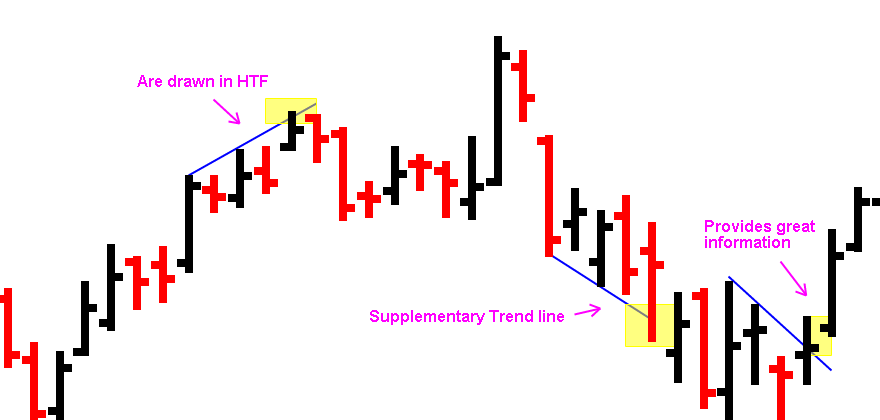

Supplement Trend Lines: In general, the strength of a trend line depends on the swing points used to define the line. However, there are some special cases where very short-term trend lines without good swings may give good trading signals. At some point in your development as trader, you may find that these small trend lines offer some interesting opportunities for precisely timing entries. This line is not even a trend line proper, in that we do not look for the slope of the line to contain prices or to define the trend. Rather, the point where the line intersects today’s prices is a potential reversal or inflection point.

Important Points to keep in mind about Supplement Trend Lines

Markets rarely trend at one simple, consistent rate. It is very common to see a trend line broken and for the original trend to hold, albeit at a more shallow slope. This is one reason, trading on breaks of trend lines is frustrating. In many cases where markets are flat, and it is possible to draw trend lines that touch the tops or bottoms of many consecutive price bars. These types of trend lines do not tend to be very significant. They are penetrated easily by the smallest motions in the market, and there is no reliable price action after the penetration. Avoid drawing these trend lines in flat markets with no definable swings.

LEARN HOW TO BE A SUCCESSFUL TREND TRADER FROM MY TREND TRADING COURSE CLICK HERE TO KNOW MORE!!