SBI Share prices declined almost 8.00% within last few days. SBI is not the only one, many other state-run public sector banks fell more than 16%, and some major names such as Indian Bank, Canara bank, IDBI saw negative sentiment. The primary theme driving the share prices of PSU banks is the concern of Investors about forced merger announcements by the Government and prevailing liquidity issues. Some prominent investors and Smart players feel that forced mergers of PSU Banks in this environment might do more harm than good

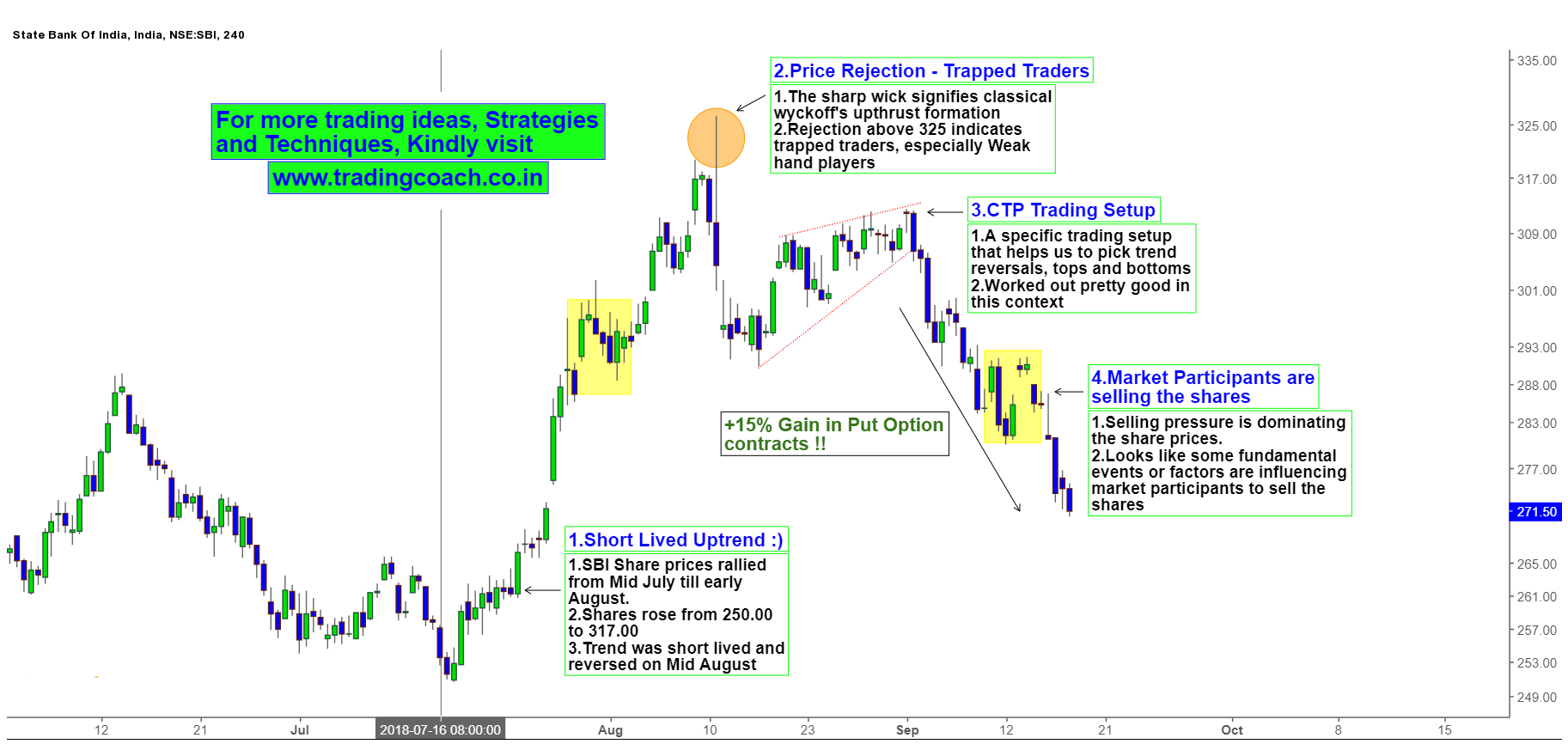

SBI Price Action Analysis reveals the Negative bias of Investors

Share prices plunged on concern that forced mergers might lead to higher provisioning for Bad loans which can drag down the profit margins of good PSU Banks and might cause liquidity crunch. Recent Government proposal to merge 3 major PSU banks, Dena Bank, Bank of Baroda and Vijaya Bank has caused a major unease among Investors and Shareholders. Recent issues of liquidity problems in the economy further influenced the negative bias of Investors.

Technically most of PSU Bank stocks are in downtrend from last few months. Market participants fear that more consolidation and merger proposals are on the track which could alleviate liquidity crises. Consolidating small banks with weak financials into bigger ones can trigger further downfall, as shares of the consolidated banks must be liquidated. Traders and Investors must keep a close watch on this theme, which can drive the market sentiment in coming weeks. Generally taking non – directional option trades combined with Price action setups can yield better results in these types of environment.