Ruchi Soya, the largest manufacturer of Edible Oil in the country, is also a Buzz stock on Dalal Street in recent days.

The company listed their FPO – Follow on Public Offer, to attract new investors and diversify their holding base.

But however, here’s the major problem with the Stock – Price Gaps, which indicates a more serious underlying problem called Low Liquidity.

Instead of going through all the complicated vocabulary of finance, let me put it in a simple way: lower the Liquidity, the more difficult it is to sell the stock when the market crashes.

So what’s the indication of Low Liquidity? Price Gaps, a lot of them. That’s exactly what we see in Ruchi Soya.

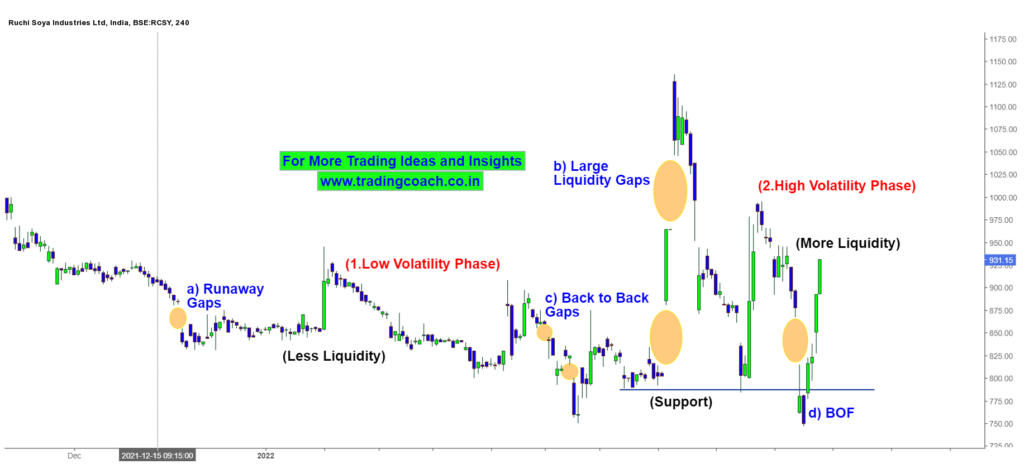

Take a look at the Chart Analysis over here…

Ruchi Soya – Price and Volatility Analysis on 4h Chart

We can notice that prices gravitated from Low Volatility to High Volatility after the announcement of FPO.

Apart from that, there are price gaps, both large and small, throughout both the phases.

Despite the Higher Volatility, we are not seeing much liquidity in the Ruchi Soya Stock prices. This can be a concern when the stock prices go into a free fall!

Even candlesticks, patterns or Indicators don’t work well in these types of Low liquid stocks. Take a look at the video below to understand about the Price Action of Candlesticks in depth.

So finally, what’s the lesson here? Beware when you’re dealing with stocks that have less liquidity.