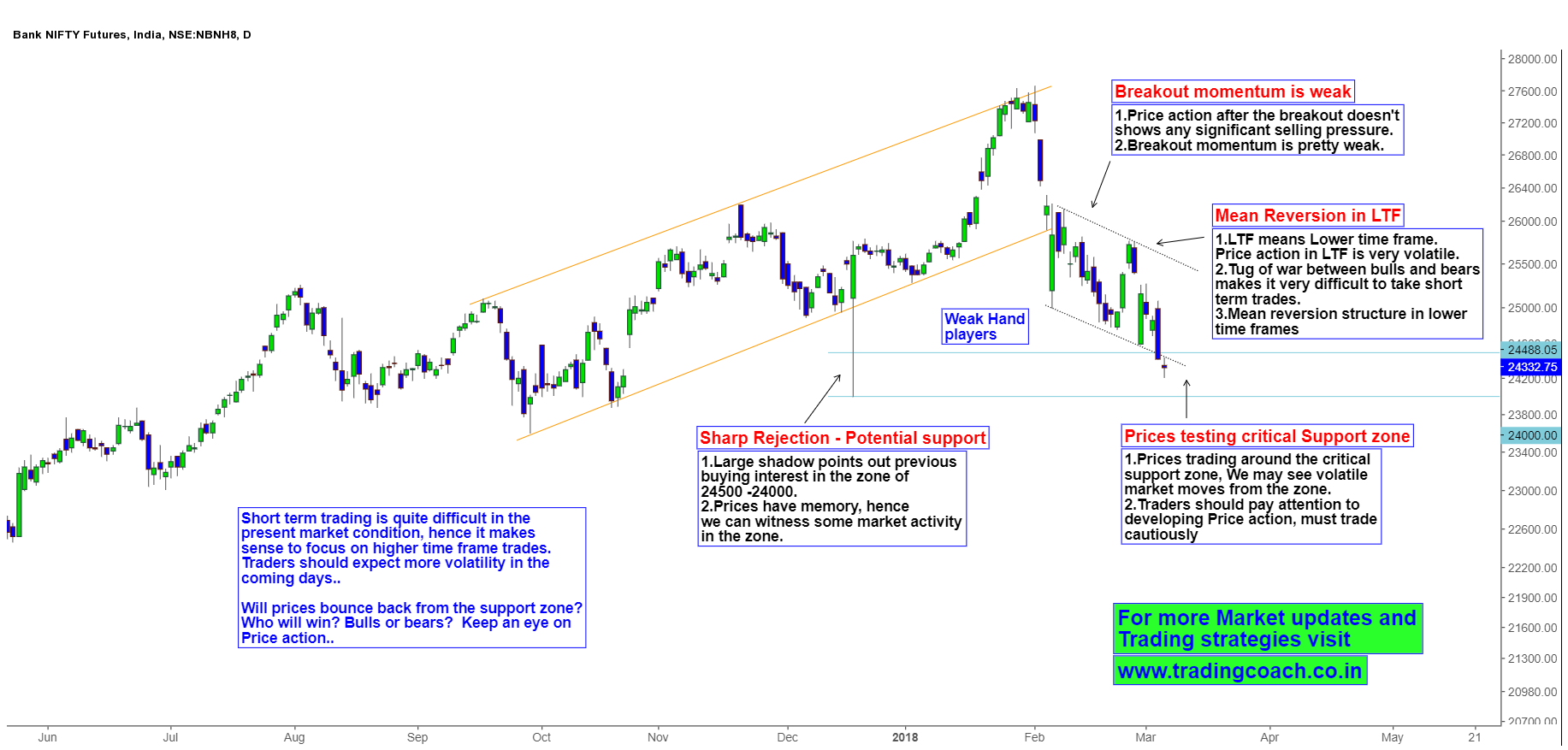

In my previous article on Bank nifty, I have pointed out that Structural support zone at 24000 – 24500 is important to determine future market direction. It’s essential to watch how market prices are going to behave around the zone. Now Price action is testing that critical support zone, we might see volatile market moves in upcoming days. Whatever happens around this key support zone can influence the decision-making of Major market players and Market sentiment.

Bank Nifty testing the critical Support zone

From last couple of days, Price action of Bank nifty in lower time frame was very volatile, making it hard to focus on short-term trading setups. Noisy market fluctuation combined with volatility made it difficult to take trading decisions. Though it seems like prices are generally falling down, multiple bullish moves and whipsaws clearly indicates mean reversion context in Lower time frame.

What’s the reason behind such a terrific price movements? It’s the offsetting order flow by both FII’s and DII’s. FII’s are exiting from the markets and DII’s are continuing to buy more shares. Have a look at the FII – DII net holding reports from last 2 months, everything clearly makes sense. Both buying and selling pressure is contradicting each other, creating hectic price movements.

Currently prices are testing the potential support zone at 24000 – 24500. Will the prices bounce back from the support zone? Since both buying (DII’s) and selling pressure (FII’s) is offsetting each other which side is likely to win? Bulls or bears? Market conditions are not favorable; traders must pay attention to developing Price action and trade cautiously with proper risk management.