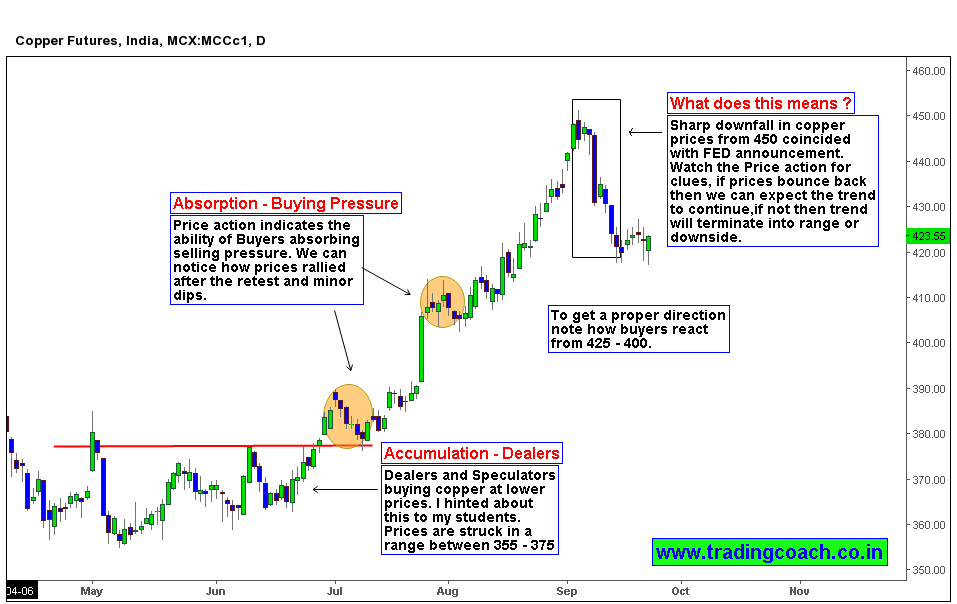

Copper Prices rallied from 355 – 450 in a span of 5 months (from May – August). The main driver was safe heaven flow seeking accommodation in base metals because of geopolitical landscape. Market participants like dealers and speculators bought Copper in the lower price zone of 355-375, they’ve benefited most from the rally.

We can notice the Uptrend clearly on Daily chart (MCX Copper), momentum of the trend was strong from May – August but lost grip in September. There are two reasons for that, first thing is Market participants focus shifting from North Korean tensions to Fed’s Monetary tightening policy and Secondly inverse intermarket co – relationship between Copper and Dollar. It’s an obvious fact that Copper and Dollar has negative co – relation, when dollar rises – copper falls and Vice versa. Read this short article to know about Intermarket analysis

Recent selloff in Copper is an indication of Bears challenging the Uptrend; also downfall coincided with FED’s announcement from which we can conclude Investors are more concerned about FED Hikes than geopolitical tensions.

Will the uptrend in copper continue or reverse? To get clarity keep observing how bulls are going to react at 400 – 425 Support zone. If Prices bounce back we can expect the trend to continue, if not then trend will terminate into a range or opposite trend. Watch the Price action and trade based on developing market structure.