Fundamental Outlook of Crude Oil prices

Prices surged higher ever since OPEC members surprised the market last month by agreeing over a proposed production freeze. A framework to cut production levels for the first time in 8 years hit the markets by wonder and surprise. As a result Crude oil rallied from 42.60 to 50.70 per barrel.

OPEC agreed to limit production to a range of 32.5 million to 33.00 million barrels a day. However market participants are growing skeptical over the possibilities of implementing such a production cut plan.

Upcoming days, Market will focus on US Stock piles data in relation to US drilling prospects. Any news events or announcements from OPEC and IEA will be closely monitored to gauge the supply–demand levels.

Overall Market sentiment is driven by re balancing theme, Traders and speculators will continue to watch supply disruptions and demand factors for indications.

Price Action Trading aspects of Crude Oil

By looking at the Price action on Daily chart, we can observe these vital clues to aid in decision-making process

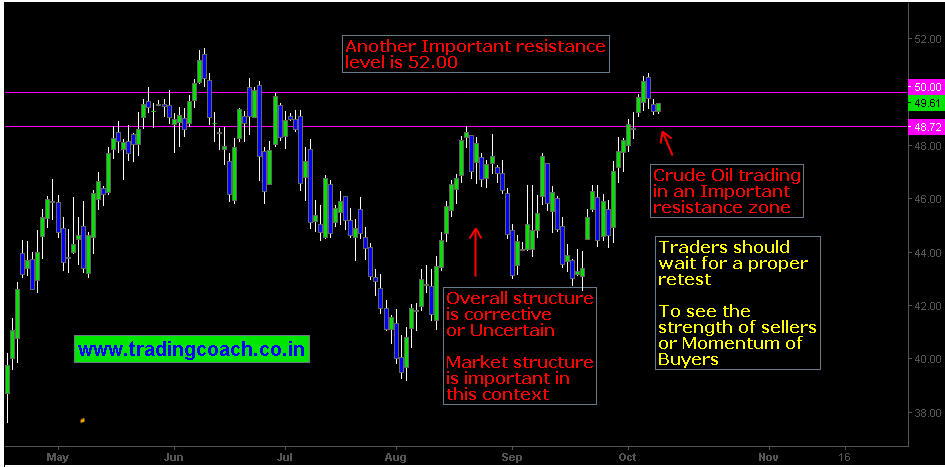

Overall Market structure is in corrective phase or Complex ranging environment. The structure is evident since June 2016. Sharp movements on both sides are resulting in counter reactions. Market structure is important to determine directional trades or trading bias. In this case, it is better to be Neutral and play good risk: reward trades on both directions. (In Swing trading context)

Price Action is now trading at important round number level 50.00. Note that it’s an important level of gauge for OPEC members to decide on production freeze. Smart money players will be closely observing this price level. Traders should see how market responds to Price Action.

Consecutive resistance levels are big hurdle for buyers. Upcoming resistance levels rest squarely around 50.00, 51.00 and 52.00. Bulls must break the zone with strong momentum or selling pressure will force the prices lower.

Before taking a trade, it is necessary to gauge the strength of buying and selling pressure, because the market structure is in corrective phase. Traders must observe the price action and find how sellers react at resistance levels and how buyers respond after selloff. Stay in tune with the Market flows.