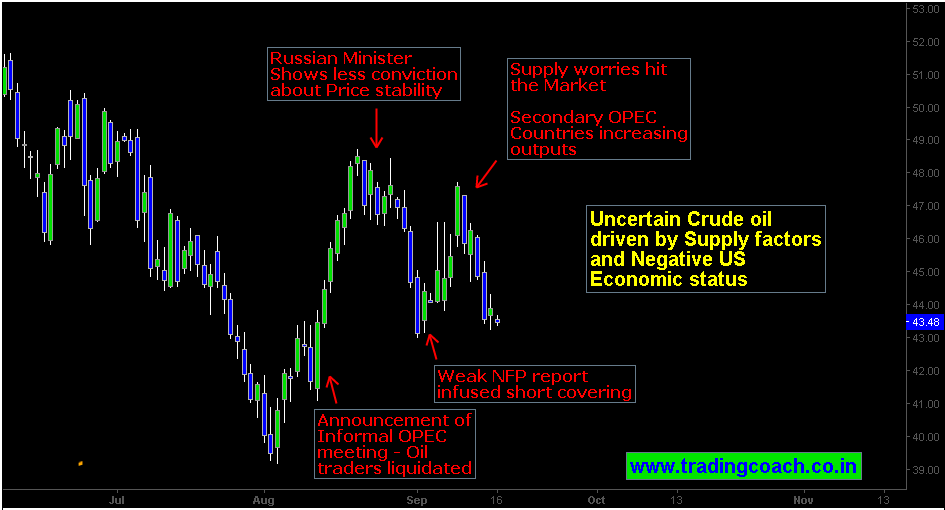

Fundamental goes hand in hand with Price Action trading, but the fundamental factors we Price action traders focus on are relatively different from conventional thinking. It can some help us to understand the market sentiment. Crude Oil is a recent example, though the Price action is highly uncertain, Fundamentals shine some light over the current situation. The barrier of 45.00 – 50.00 will continue to vex crude oil traders unless we see any trend creating factors. One potential risk for Price stability of Crude oil is recent production rate of Libya and Nigeria.

How Crude oil Price Action Trading as per Supply and Demand

Two OPEC producers whose supplies are crushed by country’s internal conflict are preparing to add hundreds of barrels within matter of weeks. The recent announcement from Libya and Nigeria is spurring concerns among commodity traders. A resumption of these supplies 8,00,000 barrels a day might push crude oil to brinks. On the other hand from the optimistic viewpoint OPEC are set to meet in Algiers this month to discuss over market stability and output freeze. Two contradictory factors make sense as price action consolidating at 45.00 – 50.00.

Observing the Price Action on daily chart, it’s clear that markets are driven by Supply concerns. But adding twist to the structure, the movements of US dollar is indirectly affecting crude oil prices. Negative dollars facts are triggering liquidation and position adjustment which in turn pushing prices higher. Uncertainty is still dominating Crude oil; all eyes will be on OPEC meeting at Algiers later this month. Traders be focused on Daily chart also observe how market reacts to fundamental factors.