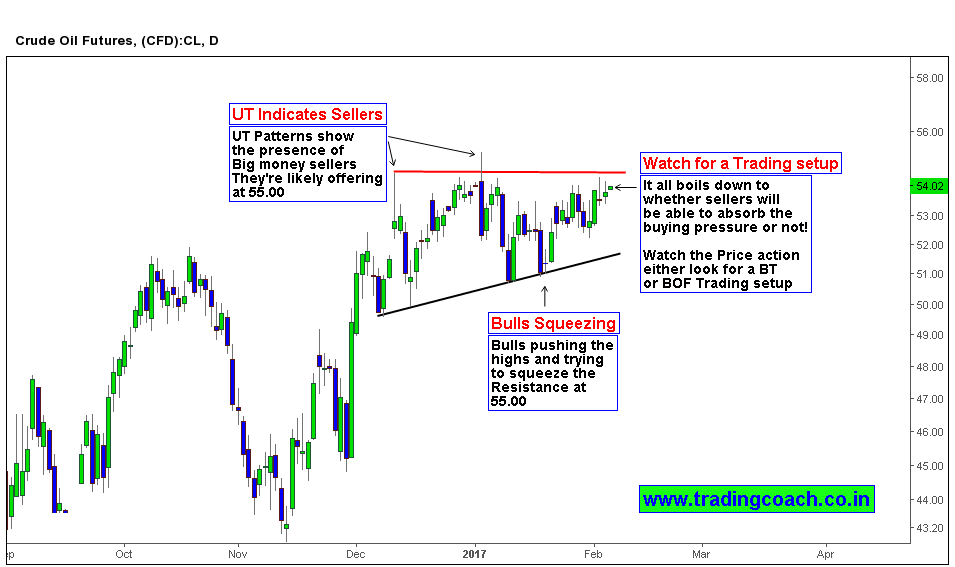

Crude Oil can offer a Price action trading setup as it edges near the Inflection point at 55.00. Inflection point or Decision Point is a Potential support or resistance level which can shape the entire Market structure and direction in coming days. Identifying such Inflection points requires skill and patience of a Price action trader. As Crude Oil inches towards 55.00, there’s a possibility of creating BOF or BT trading setup. Short term traders and Swing traders should keep your eye on MCX Crude oil.

Our Fancy US President Trump and his Geopolitics is driving World markets. Right now, Crude oil is negatively correlated with USD. By Charting the Crude Oil with DXY, you can see correlation of both assets. So, Traders must watch out for potential moves in USD to get a cue on Crude oil. Also focus on Ramblings from OPEC and Oil producing countries.