One of the lower key stocks in the financial sector has gained by more than 50% within a few weeks.

As usual, at the peak of the Uptrend, most of the small traders and weak hand investors have taken majority of their positions.

If the trend reverses, they’ll be forced to liquidate their positions. However, the Price action also shows some signs of hope for the trend continuation.

We are talking about Federal Bank. Stock prices shot up because of a rumoured merger talk with KMB.

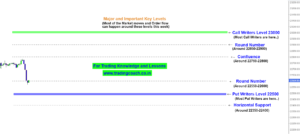

Take a look at the Price Action Outlook in the 5h time frame, highlighting the short-term trend.

Federal Bank – Price Action Analysis on 5h Time frame

On the positive side, Trend Leg and Bullish candles are getting a bit stronger. In relation to that, even the volume is increasing consistently. So there are chances of a trend continuation.

However, on the negative side, the prices are getting more volatile, so even a minor retracement will make small traders and weak hand investors vulnerable to drawdowns.

I am thinking that this stock still has some more room to rally higher before reversing.

What’s your take on Federal Bank? Will prices continue to move higher or retract lower from this point?

Leave your thoughts in the Comment section. To learn more about Price Action Analysis and Indicator less trading, checkout the video given below…