Gold recovered some of its losses after FED minutes ended up with partly mixed signals that did little to change the skepticism of Investors over imminent rate hike. Apart from a strong selloff in beginning of August which initially took prices from 1364.00 to 1330.00, Market didn’t offer any other significant movements in the precious metal.

As I pointed out in my earlier article, Gold started consolidating within the range between 1350.00-1330.00. Price action needs strong fundamental events to create decent price swings.

Gold Trading in Range Bound Market

Failure of buying pressure to make another high caused Price action to fall sharply from 1364 – 1330 marking a shift in momentum and balance of buying and selling pressure. Later price action bounced as buyers continued bidding at lower prices. Following another defense by sellers at resistance zone 1350.00 market structure shifted to ranging Price action. Markets seem to be confused as recovery in gold prices show that speculators are intact with US Economic status and FED meetings. It seems like markets still don’t expect FED to raise rates in next few months.

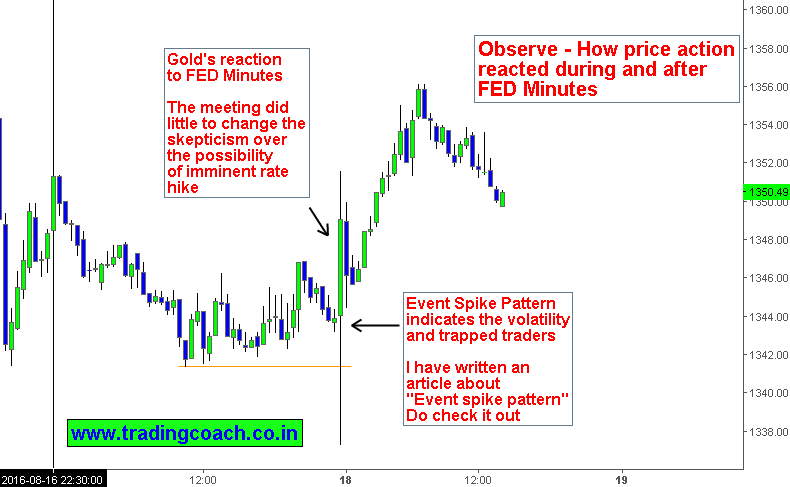

Gold Price Action following FED Minutes

When zooming in on lower time frame chart (15 Min), we can notice how gold reacted during and after FED Minutes. Price action rose and fell simultaneously as the meeting did little to change the skepticism of investors. Market structure also formed an Event spike pattern indicating the raise in volatility and trapped traders after FED minutes.

Traders should focus on Price action and watch for key results, announcements and events from United States which can hardcore impact on gold prices.