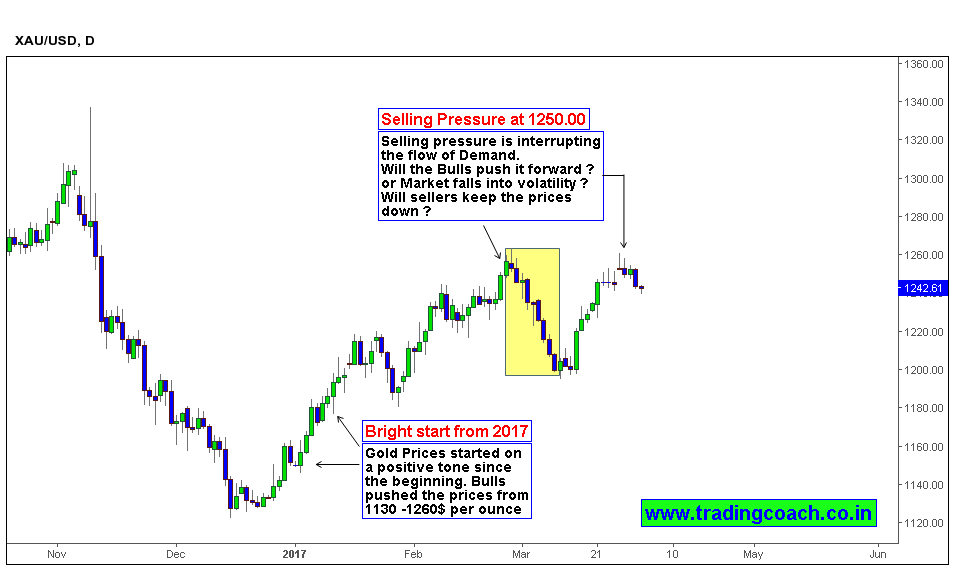

Gold facing a Key resistance level at 1250.00. Price action must clearly breach this level to continue further positive growth. Temporary fluctuations and noises beyond this resistance level can’t be considered as a valid breakout, prices should break and retest 1250.00, only then we can expect the positive tone to continue. Market may get more volatile in coming days, so traders must have a tight risk management while initiating trades.

The precious metal had a great start in the beginning of this year. Gold prices rose from 1130 – 1260$ per ounce, within a period of 2 and half months. (In Gold international spot market) But somehow the bullish tone couldn’t keep up till the end of February. After testing the resistance level at 1250.00, (also a Psychological round number) Gold prices saw a sharp selloff to 1200.00. Later prices did rebound from 1200.00, but it resulted in a sense of uncertainty for traders. Market sentiment is neutral for now, Keep watching the price action till we get some clarity.